Euro area monthly balance of payments: July 2024

19 September 2024

- Current account recorded €40 billion surplus in July 2024, down from €51 billion in previous month

- Current account surplus amounted to €388 billion (2.6% of euro area GDP) in the 12 months to July 2024, up from €71 billion (0.5%) one year earlier

- In financial account, euro area residents’ net acquisitions of non-euro area portfolio investment securities totalled €477 billion and non-residents’ net acquisitions of euro area portfolio investment securities totalled €642 billion in the 12 months to July 2024

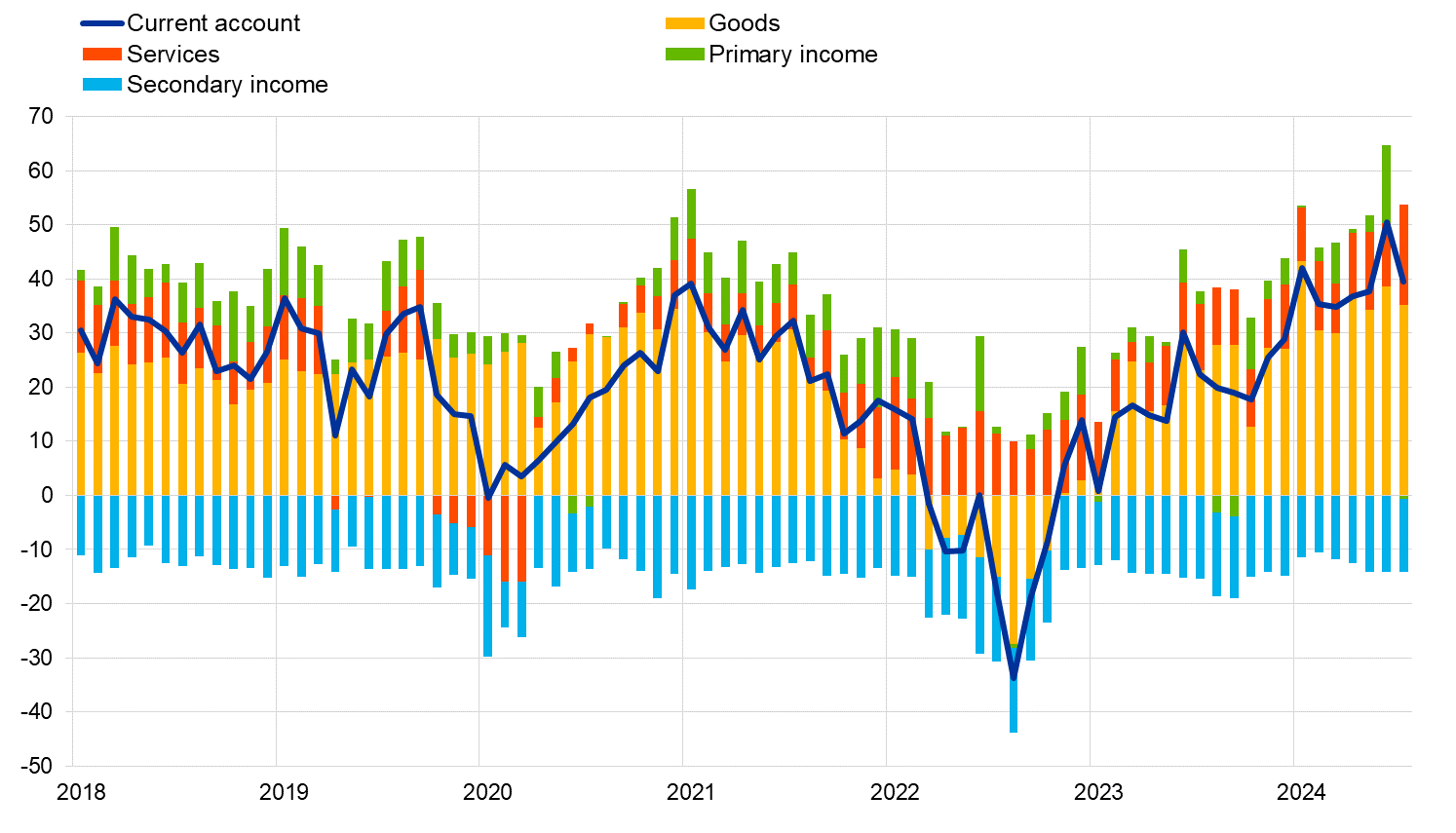

Chart 1

Euro area current account balance

(EUR billions unless otherwise indicated; working day and seasonally adjusted data)

Source: ECB.

The current account of the euro area recorded a surplus of €40 billion in July 2024, a decrease of €11 billion from the previous month (Chart 1 and Table 1). Surpluses were recorded for goods (€35 billion) and services (€19 billion). Deficits were recorded for secondary income (€13 billion) and primary income (€ 1 billion).

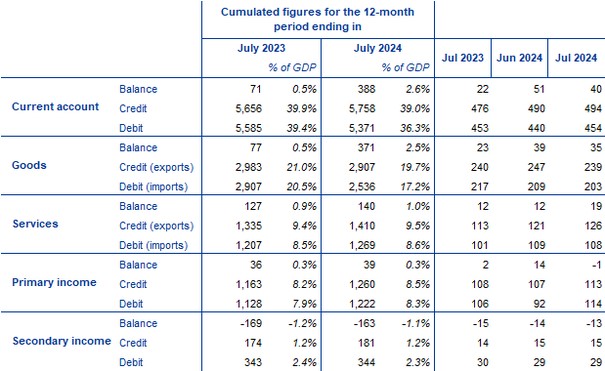

Table 1

Current account of the euro area

(EUR billions unless otherwise indicated; transactions; working day and seasonally adjusted data)

Source: ECB.

Note: Discrepancies between totals and their components may be due to rounding.

In the 12 months to July 2024, the current account surplus widened to €388 billion (2.6% of euro area GDP), up from €71 billion (0.5% of euro area GDP) one year earlier. This increase was mainly driven by a larger surplus for goods (up from €77 billion to €371 billion), and, to a lesser extent, by larger surpluses for services (up from €127 billion to €140 billion) and primary income (up from €36 billion to €39 billion), as well as a smaller deficit for secondary income (down from €169 billion to €163 billion).

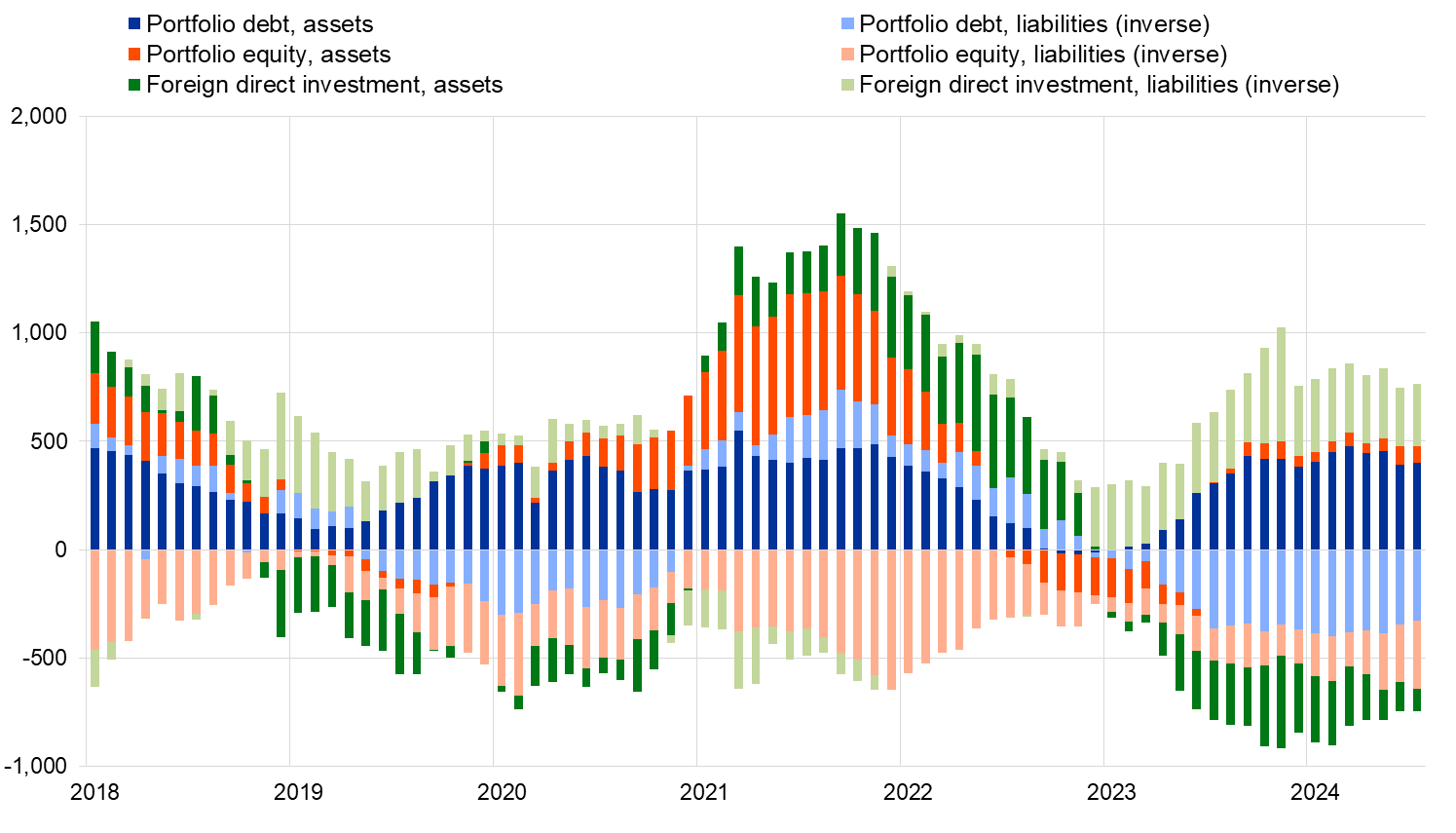

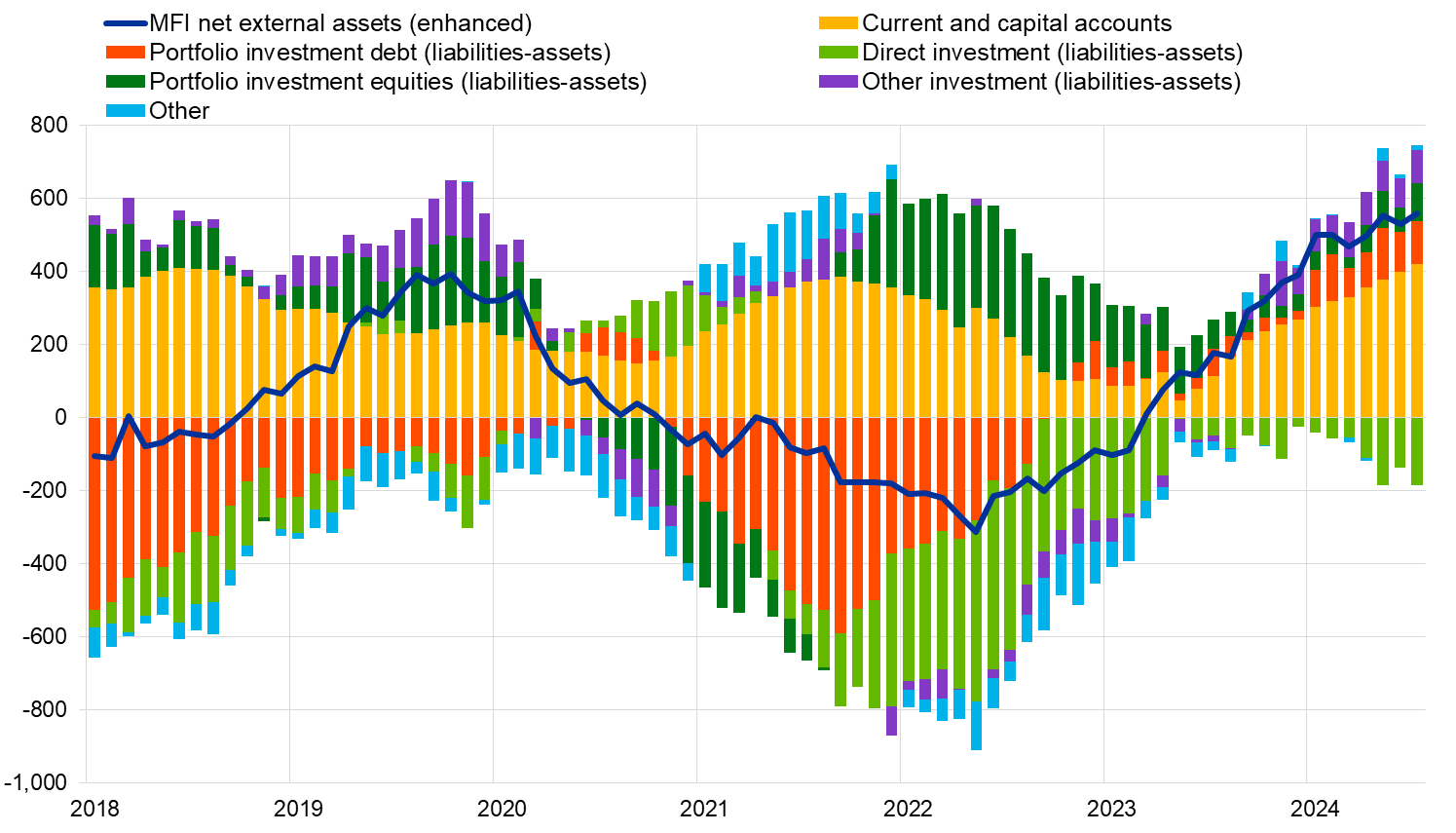

Chart 2

Selected items of the euro area financial account

(EUR billions; 12-month cumulated data)

Source: ECB.

Notes: For assets, a positive (negative) number indicates net purchases (sales) of non-euro area instruments by euro area investors. For liabilities, a positive (negative) number indicates net sales (purchases) of euro area instruments by non-euro area investors.

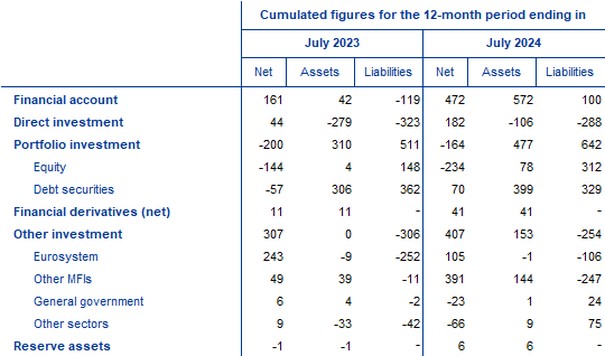

In direct investment, euro area residents made net disinvestments of €106 billion in non-euro area assets in the 12 months to July 2024, declining from net disinvestments of €279 billion one year earlier (Chart 2 and Table 2). Non-residents disinvested €288 billion in net terms from euro area assets in the 12 months to July 2024, decreasing from net disinvestments of €323 billion one year earlier.

In portfolio investment, euro area residents’ net purchases of non-euro area equity increased to €78 billion in the 12 months to July 2024, up from €4 billion one year earlier. Over the same period, net purchases of non-euro area debt securities by euro-area residents increased to €399 billion, up from €306 billion one year earlier. Non-residents’ net purchases of euro area equity increased to €312 billion in the 12 months to July 2024, up from €148 billion one year earlier. Over the same period, non-residents’ net purchases of euro area debt securities decreased to €329 billion, down from €362 billion one year earlier.

Table 2

Financial account of the euro area

(EUR billions unless otherwise indicated; transactions; non-working day and non-seasonally adjusted data)

Source: ECB.

Notes: Decreases in assets and liabilities are shown with a minus sign. Net financial derivatives are reported under assets. “MFIs” stands for monetary financial institutions. Discrepancies between totals and their components may be due to rounding.

In other investment, euro area residents recorded net acquisitions of non-euro area assets amounting to €153 billion in the 12 months to July 2024 (following net acquisitions of close to zero one year earlier), while they recorded net disposals of liabilities of €254 billion (down from €306 billion one year earlier).

Chart 3

Monetary presentation of the balance of payments

(EUR billions; 12-month cumulated data)

Source: ECB.

Notes: “MFI net external assets (enhanced)” incorporates an adjustment to the MFI net external assets (as reported in the consolidated MFI balance sheet items statistics) based on information on MFI long-term liabilities held by non-residents, available in b.o.p. statistics. B.o.p. transactions refer only to transactions of non-MFI residents of the euro area. Financial transactions are shown as liabilities net of assets. “Other” includes financial derivatives and statistical discrepancies.

The monetary presentation of the balance of payments (Chart 3) shows that the net external assets (enhanced) of euro area MFIs increased by €558 billion in the 12 months to July 2024. This increase was driven by the current and capital accounts surplus and euro area non-MFIs’ net inflows in portfolio investment debt, portfolio investment equities, other investment, and other flows. These developments were partly offset by euro area non-MFIs’ net outflows in direct investment.

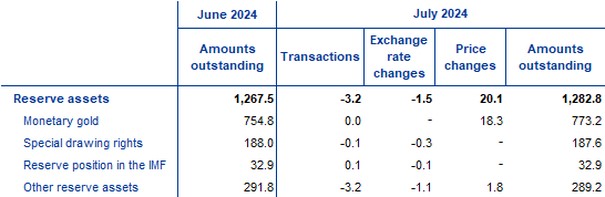

In July 2024 the Eurosystem’s stock of reserve assets increased to €1,282.8 billion up from €1,267.5 billion in the previous month (Table 3). This increase was mainly driven by positive price changes (€20.1 billion), mostly due to an increase in the price of gold. This development was partly offset by net sales of assets (€3.2 billion) and negative exchange rate changes (€1.5 billion).

Table 3

Reserve assets of the euro area

(EUR billions; amounts outstanding at the end of the period, flows during the period; non-working day and non-seasonally adjusted data)

Source: ECB.

Notes: “Other reserve assets” comprises currency and deposits, securities, financial derivatives (net) and other claims. Discrepancies between totals and their components may be due to rounding.

Data revisions

This press release does not incorporate revisions to previous periods.

Next releases:

- Quarterly balance of payments: 04 October 2024 (reference data up to the second quarter of 2024)

- Monthly balance of payments: 18 October 2024 (reference data up to August 2024)

For media queries, please contact Nicos Keranis, tel.: +49 69 1344 5482.

Notes

- Current account data are always seasonally and working day-adjusted, unless otherwise indicated, whereas capital and financial account data are neither seasonally nor working day-adjusted.

- Hyperlinks in this press release lead to data that may change with subsequent releases as a result of revisions.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts-

19 September 2024

Poslední zprávy z rubriky Makroekonomika:

Přečtěte si také:

Příbuzné stránky

- Státní svátky 2024

- Kalendář jmen 2024 - svátky

- Prázdniny 2024/2025 nezveřejněny

- Ošetřovné 2024 - kalkulačka: celkem 6.399 Kč za 9 dnů ošetřovného při příjmu 40.000 Kč. O 27 Kč více než vloni.

- Nemocenská 2024 - kalkulačka: lidé s příjmy nad 41.000 Kč si na nemocenské letos mírně polepší.

- Zálohy OSVČ 2024 - sociální a zdravotní pojištění. Minimální zálohy, splatnost, paušální daň, nemocenské pojištění

- Aktuální změny ve výpočtu čisté mzdy v roce 2024. O kolik se vám zvýší čistá mzda?

- Daň z nemovitých věcí - formulář 2024

- Minimální mzda 2024

- Nezabavitelná částka 2024 - kalkulačka: snížení normativních nákladů

- Předdůchod 2024 - kalkulačka: na 5 let předdůchodu musíte naspořit 763.680 Kč.

- Daň z příjmů fyzických osob - formulář 2024

Prezentace

02.04.2025 Firmy a podnikatelé si loni půjčili 168…

14.03.2025 MacBook za polovinu. V Česku je nová služba,…

10.03.2025 Nejpopulárnější Samsung má nástupce.