Euro area monthly balance of payments: April 2024

19 June 2024

- Current account recorded €39 billion surplus in April 2024, up from €36 billion in previous month

- Current account surplus amounted to €337 billion (2.3% of euro area GDP) in the 12 months to April 2024, after a €53 billion deficit (0.4%) one year earlier

- In financial account, euro area residents’ net acquisitions of non-euro area portfolio investment securities totalled €433 billion and non-residents’ net acquisitions of euro area portfolio investment securities totalled €585 billion in the 12 months to April 2024

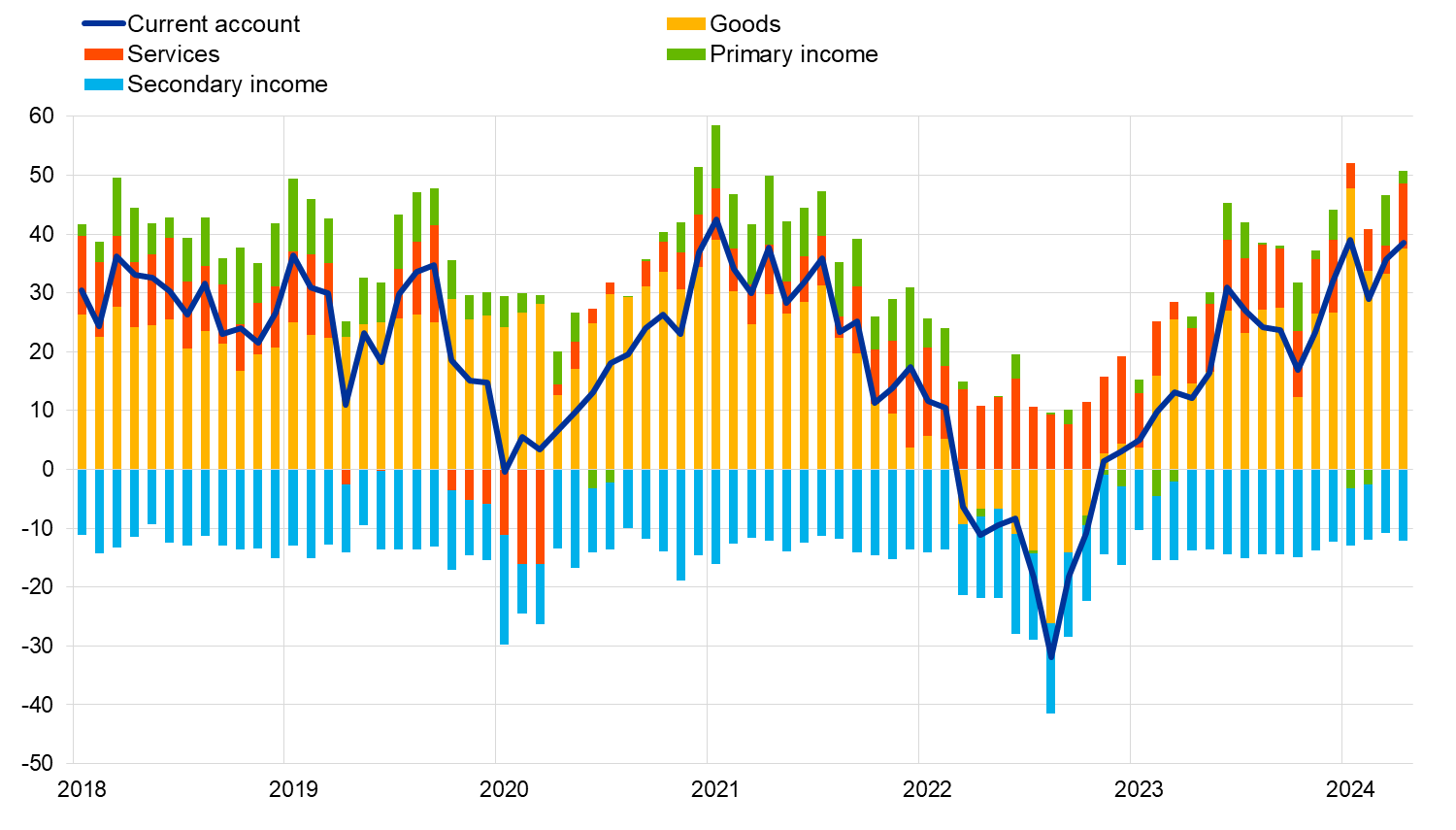

Chart 1

Euro area current account balance

(EUR billions unless otherwise indicated; working day and seasonally adjusted data)

Source: ECB.

The current account of the euro area recorded a surplus of €39 billion in April 2024, an increase of €3 billion from the previous month (Chart 1 and Table 1). Surpluses were recorded for goods (€38 billion), services (€11 billion) and primary income (€ 2 billion). These were partly offset by a deficit for secondary income (€12 billion).

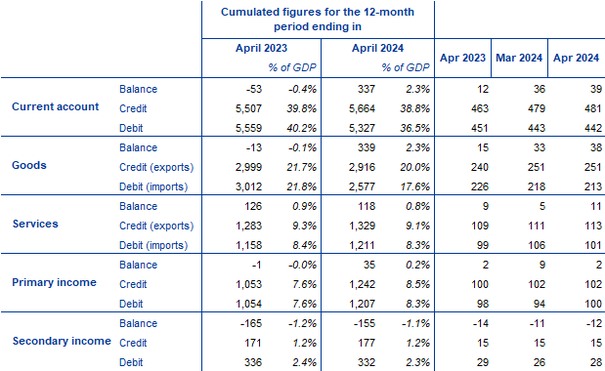

Table 1

Current account of the euro area

(EUR billions unless otherwise indicated; transactions; working day and seasonally adjusted data)

Source: ECB.

Note: Discrepancies between totals and their components may be due to rounding.

In the 12 months to April 2024, the current account recorded a surplus of €337 billion (2.3% of euro area GDP), compared with a deficit of €53 billion (0.4% of euro area GDP) one year earlier. This increase was mainly driven by a switch from a deficit (€13 billion) to a surplus (€339 billion) for goods and, to a lesser extent, by a switch from a deficit (€1 billion) to a surplus (€35 billion) for primary income, as well as by a smaller deficit for secondary income (down from €165 billion to €155 billion). These developments were partly offset by reduction in the surplus for services (down from €126 billion to €118 billion).

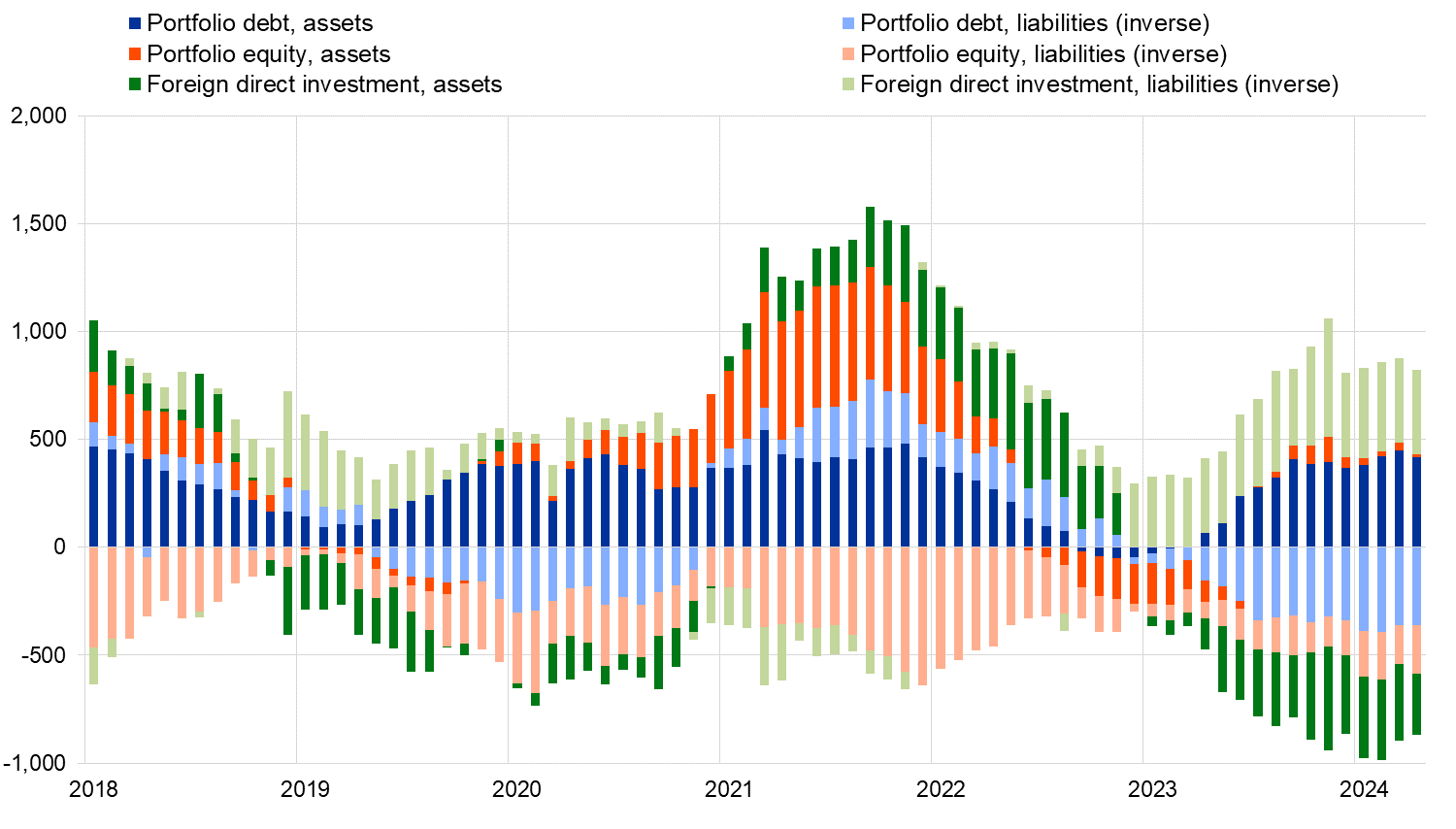

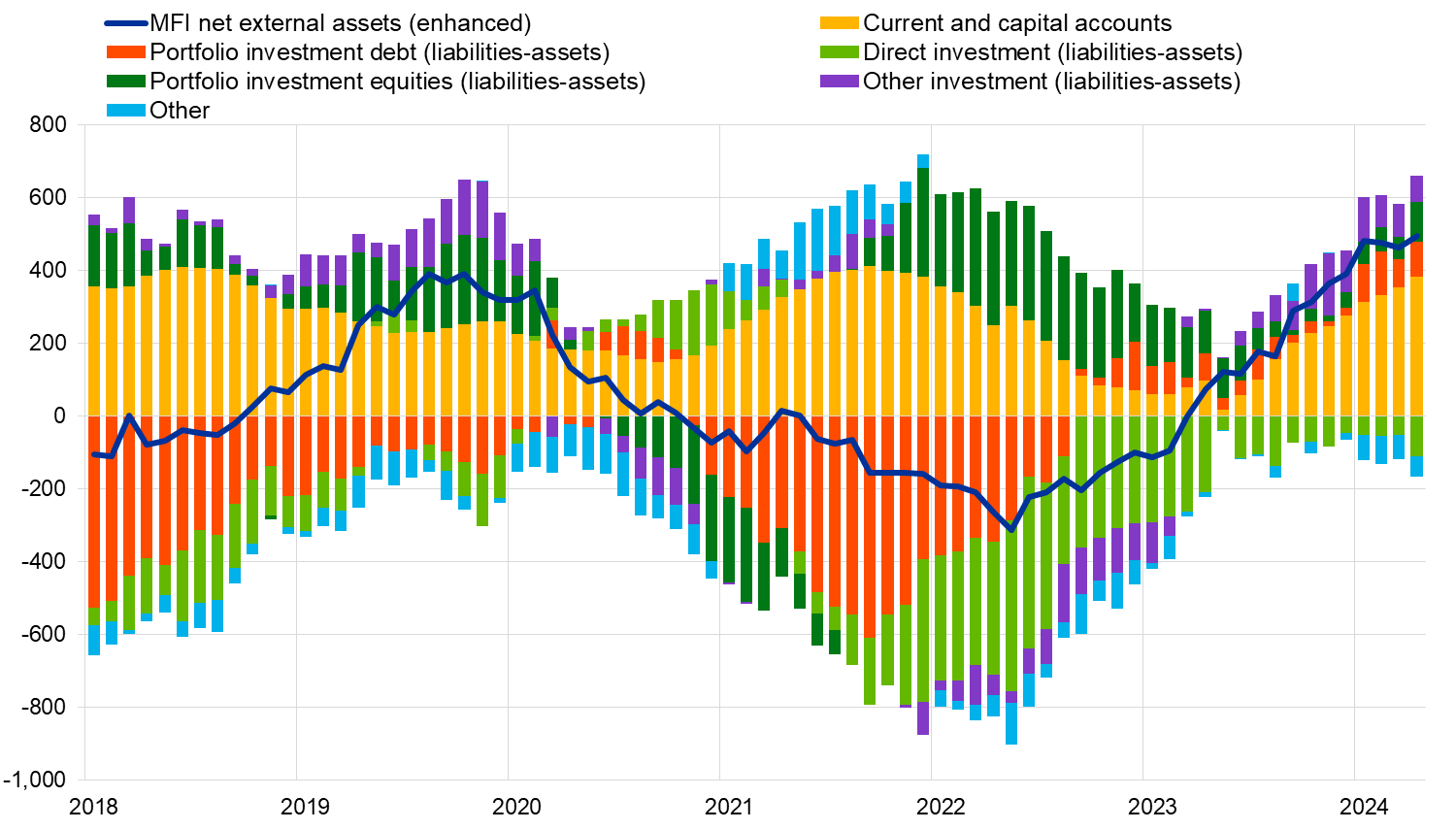

Chart 2

Selected items of the euro area financial account

(EUR billions; 12-month cumulated data)

Source: ECB.

Notes: For assets, a positive (negative) number indicates net purchases (sales) of non-euro area instruments by euro area investors. For liabilities, a positive (negative) number indicates net sales (purchases) of euro area instruments by non-euro area investors.

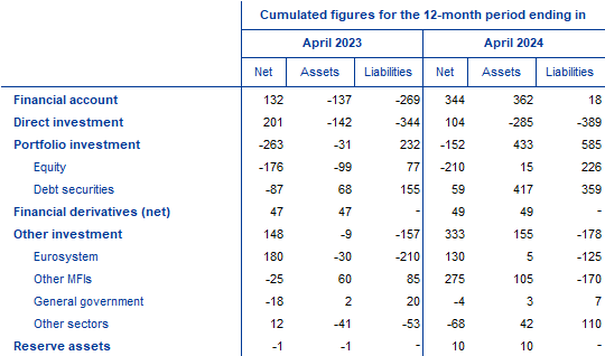

In direct investment, euro area residents made net disinvestments of €285 billion in non-euro area assets in the 12 months to April 2024, increasing from net disinvestments of €142 billion one year earlier (Chart 2 and Table 2). Non-residents disinvested €389 billion in net terms from euro area assets in the 12 months to April 2024, up from net disinvestments of €344 billion one year earlier.

In portfolio investment, euro area residents’ net purchases of non-euro area equity amounted to €15 billion in the 12 months to April 2024, after net sales of €99 billion one year earlier. Over the same period, net purchases of non-euro area debt securities by euro-area residents increased to €417 billion, up from €68 billion one year earlier. Non-residents’ net purchases of euro area equity increased to €226 billion in the 12 months to April 2024, up from €77 billion one year earlier. Over the same period, non-residents net purchases of euro area debt securities rose to €359 billion, up from €155 billion one year earlier.

Table 2

Financial account of the euro area

Source: ECB.

Notes: Decreases in assets and liabilities are shown with a minus sign. Net financial derivatives are reported under assets. “MFIs” stands for monetary financial institutions. Discrepancies between totals and their components may be due to rounding.

In other investment, euro area residents recorded net acquisitions of non-euro area assets amounting to €155 billion in the 12 months to April 2024 (following net disposals of €9 billion one year earlier), while they recorded net disposals of liabilities of €178 billion (up from €157 billion one year earlier).

Chart 3

Monetary presentation of the balance of payments

(EUR billions; 12-month cumulated data)

Source: ECB.

Notes: “MFI net external assets (enhanced)” incorporates an adjustment to the MFI net external assets (as reported in the consolidated MFI balance sheet items statistics) based on information on MFI long-term liabilities held by non-residents, available in b.o.p. statistics. B.o.p. transactions refer only to transactions of non-MFI residents of the euro area. Financial transactions are shown as liabilities net of assets. “Other” includes financial derivatives and statistical discrepancies.

The monetary presentation of the balance of payments (Chart 3) shows that the net external assets (enhanced) of euro area MFIs increased by €494 billion in the 12 months to April 2024. This increase was mainly driven by the current and capital accounts surplus and, to a lesser extent, by euro area non-MFIs’ net inflows in portfolio investment equity, portfolio investment debt and other investment. These developments were partly offset by euro area non-MFIs’ net outflows in direct investment and other flows.

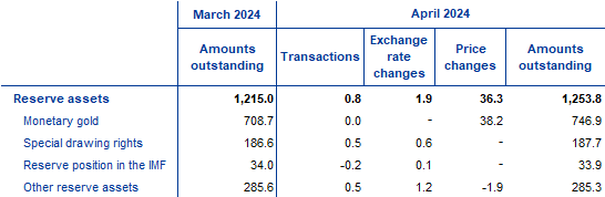

In April 2024 the Eurosystem’s stock of reserve assets increased to €1,253.8 billion up from €1,215.0 billion in the previous month (Table 3). This increase was mostly driven by positive price changes (€36.3 billion) and, to a lesser extent, by positive exchange rate changes (€1.9 billion) and net acquisitions of assets (€0.8 billion).

Table 3

Reserve assets of the euro area

(EUR billions; amounts outstanding at the end of the period, flows during the period; non-working day and non-seasonally adjusted data)

Source: ECB.

Notes: “Other reserve assets” comprises currency and deposits, securities, financial derivatives (net) and other claims. Discrepancies between totals and their components may be due to rounding.

Data revisions

This press release does not incorporate revisions to previous periods.

Next releases:

- Quarterly balance of payments: 04 July 2024 (reference data up to the first quarter of 2024)

- Monthly balance of payments: 19 July 2024 (reference data up to May 2024)

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- Current account data are always seasonally and working day-adjusted, unless otherwise indicated, whereas capital and financial account data are neither seasonally nor working day-adjusted.

- Hyperlinks in this press release lead to data that may change with subsequent releases as a result of revisions.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contactsPoslední zprávy z rubriky Měny-forex:

Přečtěte si také:

Příbuzné stránky

- Kurz Eura, Euro EUR, aktuální kurzy koruny a měn

- Státní svátky 2024

- Kalendář jmen 2024 - svátky

- Prázdniny 2024/2025 nezveřejněny

- Státní svátky Prosinec 2024

- Kalendář jmen Listopad 2024 - svátky

- Kalendář jmen Prosinec 2024 - svátky

- Kalkulačka OSVČ 2024 (za rok 2023) - výpočet daně, sociálního a zdravotního pojištění

- Rodičovský příspěvek 2024 - kalkulačka. Nárok na celkem 350.000 Kč na 1 dítě a 525.000 Kč na vícerčata mají všichni rodiče. Liší se rychlost čerpání.

- Zvýšení důchodu 2024 - kalkulačka: důchod 18.000 Kč se od června 2023 zvýší o 722 Kč.

- Ošetřovné 2024 - kalkulačka: celkem 6.399 Kč za 9 dnů ošetřovného při příjmu 40.000 Kč. O 27 Kč více než vloni.

- Nemocenská 2024 - kalkulačka: lidé s příjmy nad 41.000 Kč si na nemocenské letos mírně polepší.

Benzín a nafta 02.01.2025

| Natural 95 35.66 Kč | Nafta 34.85 Kč |

Prezentace

27.12.2024 Stále více lidí investuje do bitcoinu.

18.12.2024 Apple iPad je rekordně levný, vyjde teď jen na 8

Okénko investora

Ole Hansen, Saxo Bank

Šokující předpověď - Ceny elektřiny se zblázní a USA zdaní datová centra AI

Radoslav Jusko, Ronda Invest

AI, demografie a ženy investorky. Investiční trendy pro rok 2025

Miroslav Novák, AKCENTA

ČNB v prosinci přerušila, nikoliv však zastavila cyklus uvolňování měnové politiky

Petr Lajsek, Purple Trading

Olívia Lacenová, Wonderinterest Trading Ltd.

Mgr. Timur Barotov, BHS

Ali Daylami, BITmarkets

Jakub Petruška, Zlaťáky.cz

S návratem Donalda Trumpa zlato prudce klesá. Trhy zachvátila pozitivní nálada

Jiří Cimpel, Cimpel & Partneři

Portfolio 60/40: Nadčasová strategie pro dlouhodobé investory