The Eurosystem policy response to developments in retail payments

The Eurosystem policy response to developments in retail payments

Prepared by Patrick Papsdorf and Karine Themejian

1 Introduction

Retail payments – those made between consumers, businesses and public administrations – are undergoing profound changes that are reshaping the European payments landscape. Digitalisation is playing a major role in this, with a trend towards the increased use of cashless payment instruments, instantaneity and a truly seamless payment experience. Numerous innovative payment solutions are being developed and offered. These are made possible through the use of new technology and are further characterised by the need to enhance global and cross-border use cases, as well as the consideration that solutions can be rolled out globally.[1] These trends and developments are not only driven by existing players in the payments market. The payments business also attracts start-up firms, as well as established firms that are new to payments.

Developments in retail payments require multi-faceted actions from a Eurosystem perspective to ensure a safe, integrated, innovative and competitive euro retail payments market, with continued access to public money. The Eurosystem – the European Central Bank and the national central banks of those EU Member States that have adopted the euro – has a mandate to promote the smooth functioning of the payment system from a holistic perspective. From the perspective of retail payments, the smooth functioning of the payment system means ensuring that, in their tangible interaction with the euro, people and businesses are able to make safe and efficient payments and thus their trust in the currency is maintained. To this end, the Eurosystem is responsible for issuing public money, currently in the form of cash, which may possibly be complemented by a digital version, i.e. a digital euro. In addition, the Eurosystem can act: (i) as a catalyst for change, promoting efficiency in the field of retail payments; (ii) as overseer, setting retail payment standards and rules and ensuring compliance; and (iii) as an operator, having the possibility to set up public infrastructures. The trends at work in the retail payments landscape have the potential to bring benefits to consumers and businesses alike. However, they also carry risk and will require the Eurosystem to take action in its different capacities.

This article looks at the changing retail payments ecosystem (Section 2), before turning to the Eurosystem’s multi-faceted policy response (Section 3) and providing perspectives on the way ahead (Section 4).

2 A changing retail payments ecosystem

Digitalisation is transforming the way we live, communicate, consume and interact with the financial system, especially the way we pay. Consumers increasingly expect businesses to offer services online – ideally 24 hours a day, seven days a week – and to be able to pay also online using their preferred payment method. Similarly, consumers at point of sale expect to be able to choose between cash and non-cash payment methods, and even to pay contactless, for instance using a digital wallet on a mobile device.[2] At the same time, they expect to be able to pay quickly and not to wait long for payment authorisation, in the knowledge that payment data will be kept private and the whole purchase process is secure. Moreover, consumers expect there to be only low or no transaction fees. While these aspects certainly resonate with many businesses, they require investment and the support of payment service providers.

Changes in the retail payments ecosystem are driven by a number of factors. Besides consumers’ and businesses’ preferences and needs (Box 1), changes in the retail payments ecosystem are also influenced by other factors. The following are deemed the most impactful. First, increased interaction and integration at the global level means a potential for retail payment solutions to be offered across borders and to address cross-border payment use cases. Second, crises and geopolitical developments can lead to an acceleration in ongoing trends. For instance, the coronavirus pandemic boosted the need for online and contactless payments, an increased awareness of the climate crisis prompted calls for sustainable payments processing and geopolitical developments have drawn attention to potential operational disruptions and cyber risks (notably power outages, supply chain dependencies and the heightened risk of cyberattacks).Third, regulatory activities aimed at fostering payment innovation and addressing retail payment risks (like the risk of fraud) are shaping the retail payments area. Examples of such activities are the recent EU regulatory initiatives in the field of crypto-assets, digital operational resilience and instant payments, to name but a few.[3]

Technological developments are a main enabler of the evolution in retail payments. The internet has allowed everyone to connect online and to shop and pay online. The broad availability of smart devices and the development of contactless technology for proximity payments then combined, bringing us mobile contactless payments. Additionally, increases in computational power have led to massive gains in capacity and speed, supporting faster and lower-cost retail payments. Artificial intelligence applications may have a use, for instance, in helping identify anomalous transactions and payment behaviour to prevent fraud. However, there are also concerns about this technology, such as its use in sophisticated cyberattacks like phishing. Despite some concerns (notably on the capacity to handle high volume activity at speed), distributed ledger technology is seen by some as a technology that can possibly bring benefits to payment processing, potentially facilitating payments for streaming services, micro-payments and the programmability of payments.[4]

Technology-enabled innovation in financial services, including retail payments, is driven by multiple players. The Financial Stability Board (FSB) defines fintech as “technologically enabled innovation in financial services that could result in new business models, applications, processes or products with an associated material effect on financial markets and institutions and the provision of financial services”.[5] This means innovation can be introduced by existing payment players (so-called “incumbents”), as well as by existing non-financial firms that are expanding into financial services or entirely new firms (start-ups). The motivation behind firms active in retail payments varies considerably. They may be aiming to protect or to increase their existing market shares, or even to offer broader services to customers. Alternatively, they may wish to leverage value chains, gain access to payments data or enter the existing payments market with new business models and the ambition to address inefficiencies or shortcomings.

Another perspective from which to describe the changing ecosystem is to look at what financial services are offered and how they are affected, especially by technology. If combined with technological developments, financial services – like payment services – will evolve. For instance, payments in the form of credit transfers have developed with the option of instant payments that can be made by end users around the clock and settled within seconds with irrevocability. This is a major development, as real-time payments used to be only available in the wholesale market, i.e. to financial institutions participating in real-time gross settlement systems. A very different example of technological impact is the case of crypto-assets. The terms used in the crypto-asset space are often similar to those used in financial services, although usually they are subject to less stringent regulation and oversight or are not (yet) regulated. When it comes to crypto-assets, it is worth noting that unbacked crypto-assets show high price volatility owing to their missing inherent value. They are therefore not suited to the payment function and are merely a speculative instrument, often likened to gambling.[6]

Developments in retail payments can bring both opportunities and challenges. Digitalisation can unlock efficiency gains and improve the competitiveness of the players that embrace them. It can also allow for more user-friendly and potentially safer payment solutions for end users. It could even have the potential to help step up financial inclusion. Nevertheless, it also comes with a number of risks. It may introduce fragmentation in the euro retail payments market if innovative payment solutions are developed as closed-loop solutions, meaning that a solution can only be used in a specific ecosystem with no scope for interoperability. It may also carry the risk of excluding vulnerable individuals who, for various reasons, may not be in a position to take advantage of innovative payment solutions aimed at making retail payments safe and efficient. Finally, the more numerous digital interconnections and digital infrastructures, the greater the exposure to cyberattacks.[7]

Box 1

Developments in consumers’ attitudes and preferences

Monitoring developments in consumers’ payment attitudes and preferences is the basis for the ECB to help ensure consumers’ freedom to choose how they pay. The ECB therefore regularly conducts its Study on the payment attitudes of consumers in the euro area (SPACE) to understand how consumers use different payment methods and to find out about their payment preferences and perceptions concerning access to and acceptance of these means of payment.

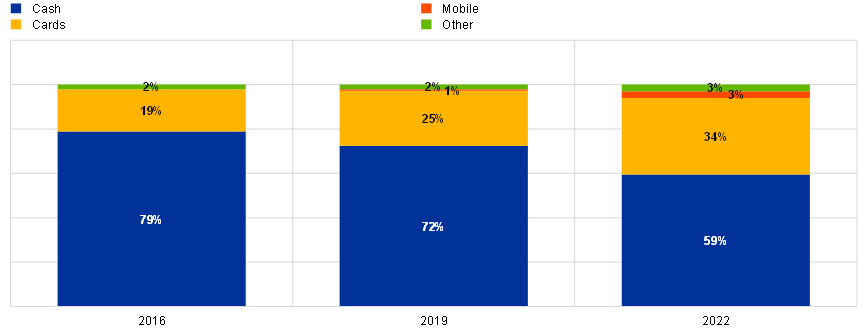

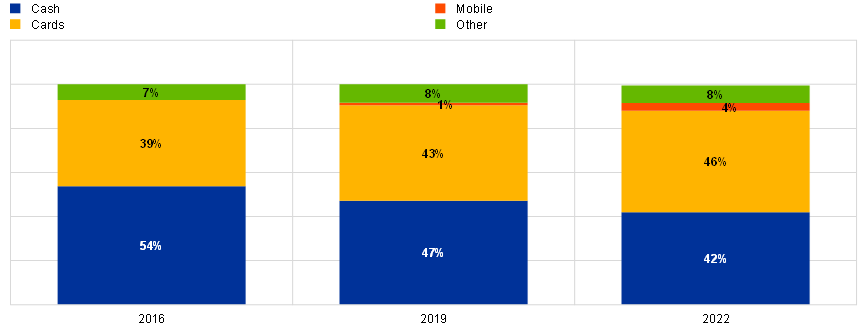

While cash plays a significant role in consumer payments in the euro area, its use appears to be gradually declining, with a shift to electronic payment methods accelerated by the pandemic. Cash continues to be the most frequently used payment option at the point of sale and for person-to-person payments. Chart A shows that, in 2022, cash was used in 59% of point-of-sale transactions, down from 72% in 2019 and 79% in 2016.[8] In terms of value, in 2022, cards accounted for a higher share of payments at the point of sale for the first time, with 46% compared with 42% for cash.

Chart A

Share of payment instruments used at the point of sale in terms of number and value of euro area transactions for the period 2016-22

a) Number of transactions

(percentages)

b) Value of transactions

(percentages)

Sources: ECB’s Study on the payment attitudes of consumers in the euro area (2022); calculations based on De Nederlandsche Bank and the Dutch Payments Association (2020 and 2022) and Deutsche Bundesbank (2018 and 2022).

Notes: “Other” includes bank cheques, credit transfers, loyalty points, vouchers and gift cards, and other payment instruments. Percentages may not add up owing to rounding.

This shift in payment means is also influenced by an increase in online payments for consumers’ day-to-day purchases, both in terms of volumes and value.

As regards electronic payments, the highest increase was recorded for mobile phone payments, albeit still at a low level, and for cards. In the case of cards, contactless payments at the point of sale have soared, accounting for 62% of all card payments in 2022. The convenience of contactless payments appears to be one of the main advantages in using cards, in addition to consumers not having to carry cash and contactless payments being perceived as faster. For payment purposes, crypto-assets appear to be used by only a very small number of consumers.

Despite the trend towards using cashless payment instruments and a declared preference for cards at the point of sale, a majority of consumers have expressed the wish to keep cash as a payment option. In 2022, 60% considered it important to have the option to pay in cash, an increase of 5 percentage points from 2019. Cash is preferred notably for its anonymity and the protection of privacy it provides, but also because there is a perception that it makes consumers more aware of how much they spend.

3 The Eurosystem’s policy response

As part of its mandate, the Eurosystem considers developments in retail payments from different perspectives as part of a comprehensive policy response. Among its main statutory objectives, the Eurosystem promotes the smooth operation of payment systems. In this context, the Eurosystem actively monitors and assesses euro area and global developments in retail payments. Given this article’s focus on the policy perspective, it does not cover the actions taken by the Eurosystem in its operator capacity, notably its service offering for instant retail payment settlement via the TARGET Instant Payment Settlement service.

The Eurosystem’s catalyst response

Further action is needed to arrive at an integrated, innovative and competitive euro retail payments market. Despite the progress made with the Single Euro Payments Area (SEPA), a European-governed solution for point-of-sale and e-commerce payments is still missing. Migration to SEPA has been achieved for credit transfers and direct debits in euro under the “SEPA end-date Regulation”, which set the deadline for migration to pan-European credit transfers and direct debits in euro.[9] In view of the increased demand for instantaneity in payments, a scheme for SEPA instant credit transfers in euro was introduced at the end of 2017. However, SEPA migration remains incomplete in some respects, with notable instances of the illegal practice of IBAN discrimination still persisting and preventing a payer from using a payment account issued in a different SEPA country. Furthermore, the SEPA vision has not materialised for card payments. As noted in Box 1, cards are a fast-growing retail payment instrument and, as observed in the latest SPACE report, even outweighed cash at the point of sale in value terms for the first time. Yet this key payment instrument for euro area consumers relies heavily on international card schemes. So far, a SEPA for cards has not been achieved. Some standardisation has taken place, but there is still no European card scheme or interoperability of domestic schemes.[10] Cross-border acceptance of national card schemes relies on “co-badging” with international card schemes. This means that commercial banks are also members of at least one international card scheme and offer cards that bear both a national and an international scheme brand. In countries where there is no national card scheme, even domestic card transactions rely on international card schemes. The increase in online payments further underlines the lack of a pan-European solution for e-commerce. Technological innovation, regulatory reforms and the increasing digitalisation of people’s daily lives have reshaped the European retail payments landscape and are set to continue to do so.[11]

The heavy reliance of a large share of euro area retail payments on non-European-governed players prompted the Eurosystem to relaunch its retail payments strategy in November 2019, outlining its expectations for payments at the point of interaction, i.e. payments at the point of sale and e-commerce.[12] While competition is an important element to ensure that the euro retail payments market remains efficient and innovative, the dominance of non-European providers raises a number of concerns about full compliance with European market requirements, the costs for merchants and thus to end users and, more generally, European sovereignty. So, as part of its relaunched strategy, the Eurosystem stated its aim of fostering the development of pan-European payment solutions for point-of-interaction payments. The Eurosystem further outlined five objectives that these solutions would have to fulfil: (i) pan-European reach and customer experience, (ii) convenience and low cost, (iii) safety and efficiency, (iv) European brand and governance, and (v) global acceptance (in the long run). In this context, the Eurosystem welcomed the European Payments Initiative, a market initiative to develop a digital wallet-based payment solution for consumers and merchants across Europe, which would cover in-store, online and person-to-person payments, as well as cash withdrawals.[13] In doing so, the ECB encouraged the pursuit of the initiative’s aim of being pan-European and, in this regard, including all markets. The Eurosystem would also support other payment solutions, provided that it is concluded that they are working to meet the above-mentioned five key objectives[14].

In October 2020 the Eurosystem complemented its strategy with further goals to support the full deployment of instant payments, the improvement of cross-border payments beyond the EU borders and active support for innovation, while bearing in mind sustainability and accessibility.[15] Retaining the support for a pan-European point-of-interaction payment solution as the first priority, the Eurosystem sought to address other areas where efforts are needed to progress towards an integrated, innovative and competitive euro retail payments market. The strategy notably aimed to address the slow deployment and uptake of instant payments since the launch of SEPA instant credit transfer. The provision of instant payments on a pan-European basis is a key enabler for innovative retail payment solutions in SEPA and is expected to unlock unrealised efficiency gains. As such, one of the major goals of the Eurosystem’s retail payments strategy is the full deployment of instant payments.

In addition to continuing its engagement with market participants, in recent years the Eurosystem has expanded the range of stakeholders it interacts with. The Eurosystem engages with market stakeholders from both the demand side and the supply side. Given the network characteristics of the retail payments industry, which requires cooperation in order to be able to compete, the Eurosystem has sought to bring relevant players together. This has been achieved notably through the Euro Retail Payments Board (ERPB), which, under a lean structure, has brought together a balanced representation of the demand and supply sides of the euro retail payments market to foster an innovative, integrated and competitive market.[16] Since it was set up towards the end of 2013, the ERPB has played an instrumental role in ensuring that developments in the euro retail payments market do not lead to fragmentation. This was the case for instant payments and more recently for open banking, being notably at the initiative of the respective developing pan-European schemes[17]. As for emerging trends in fraud, the ERPB agreed to address the issue as a priority in May 2023. The outcome of this work is expected to lead to a mapping of possible actions concerning the prevention, mitigation and investigation of fraud by different types of stakeholders. This will comply with data protection requirements and be based on an analysis of the current state of fraud for retail payment instruments, with a focus on new modus operandi and techniques. Beyond this structured institutional exchange via the ERPB, the Eurosystem has sought to enlarge the scope of its interactions by considering the evolving payments ecosystem. In this regard, in the context of its retail payments strategy, the Eurosystem has established a “European fintech payments dialogue” to discuss payment-related topics. Unlike the ERPB, this dialogue is not organised as a standing group of stakeholder associations, rather individual companies are invited to participate according to the topic to be addressed.

The Eurosystem revised and updated its retail payments strategy in 2023, in light of developments since it was first adopted, and confirmed the previous goals while adding resilience to the list.[18] To ensure that it remains fit for purpose, the Eurosystem has reviewed its strategy in light of the external developments that have affected the payments landscape since its strategy was first developed in 2019 and expanded in 2020. More specifically, these concern the continued shift of consumer behaviour towards digital payments, a growing role of big tech in retail payment solutions and the Russian war of aggression towards Ukraine, which has led to intense work to improve the resilience of the retail payments infrastructure. These developments confirmed the previous goals of the Eurosystem’s retail payments strategy while requiring changes to the actions foreseen and the addition of a new goal for increasing the resilience of retail payments. As a result of this review, the primary goal of the strategy remains that of promoting the development of a pan-European payment solution at the point of interaction. The second major goal of the strategy, the full deployment of instant payments, has been broadened to cover more generally the strengthening of the “classic SEPA”. This activity encompasses the following additional aspects: (i) the need to make the current SEPA schemes for direct debit and credit transfer future proof; (ii) the development of the SEPA Payment Account Access Scheme under the umbrella of the European Payments Council as a cornerstone for the development of open banking; and (iii) the need to take legal enforcement action against the practice of IBAN discrimination preventing a payer from using a payment account issued in a different SEPA country. Improvement of cross-border payments and the support for innovation, digitalisation and a European payments ecosystem are maintained as additional goals. In light of recent external geopolitical developments, the goal of increasing the resilience of retail payments has been added to the strategy to reflect the need for a catalyst action towards retail payment transactions besides the oversight-related work conducted in this area.

The Eurosystem’s oversight response

The Eurosystem’s oversight activities for retail payments and retail payment systems aim to ensure their safety and efficiency. Oversight, a statutory task of the Eurosystem, is defined as “(…) a central bank function whereby the objectives of safety and efficiency are promoted by monitoring existing and planned systems, assessing them against these objectives and, where necessary, inducing change.”[19] Eurosystem oversight considers the payment system in a holistic manner, comprising wholesale as well as retail payments. For the latter payments, the Eurosystem has set out its oversight requirements and expectations for retail payment systems[20], as well as those that apply to electronic payment instruments, schemes and arrangements (PISA)[21]. For overseeing systemically important payment systems (SIPS), the ECB applies hard law and has issued a Regulation.[22] For the oversight of both non-SIPS and electronic payments under the PISA framework, the Eurosystem applies soft law based on moral suasion – not excluding the fact that the Eurosystem could also use its regulatory powers and issue regulations also for non-SIPS and electronic payments. These oversight frameworks are further explained below.

In addressing the changing retail payments ecosystem, overseers monitor and assess the various developments in retail payments and ensure that oversight standards, expectations and frameworks remain fit for purpose. Oversight standards are usually developed firstly at the international level, also on the basis of contributions from central banks. The Eurosystem contributes to these global initiatives, for instance through the work of the Committee on Payments and Market Infrastructure (CPMI)[23], which, together with the Technical Committee of the International Organization of Securities Commissions (IOSCO), established the CPMI IOSCO Principles for financial market infrastructures (PFMI). These were then adopted at the Eurosystem level as oversight standards.[24] Requirements are regularly checked to see if they remain fit for purpose. For example, in 2021, the Eurosystem’s PISA oversight framework was established. This framework is based on international standards and it extended the scope of Eurosystem oversight to digital payment tokens and digital payment wallets. Similarly, in 2022, CPMI-IOSCO provided guidance on the application of the PFMI to stablecoin arrangements.[25]

In applying oversight to the various payment players in the changing retail payments ecosystem, several principles apply, especially “same function – same risk – same rules”, technological neutrality and proportionality. The first principle, “same function – same risk – same rules”, means that an innovation in retail payments is checked for similarity with existing services. If there is a resemblance in terms of function and risk, the same rules are applied. Where new risks arise, oversight rules may need to be adapted to ensure that they capture and address the new risks. For example, when considering the addition of digital payment wallets to the scope of Eurosystem oversight, the Eurosystem concluded that existing oversight rules generally applied, although with some exceptions and clarifications. The second principle of technological neutrality means that oversight standards are not written for and do not determine specific technologies but are principle-based, with an emphasis on oversight outcomes. Of course, new technologies used in the area of retail payments have to be fully understood by overseers for them be able to judge whether the technologies raise specific concerns or risks. An example of this is distributed ledger technology, where oversight analysis focuses on the impacts of the technology on, say, operational risk or settlement finality. The third principle, proportionality, means that retail payment solutions that are new and with limited business initially or, from an overall payment systems perspective, less significant in volume and value, may only need to meet less stringent requirements, may be subject to less intense oversight reporting or other activities, or may even be exempted from oversight altogether. In the context of an evolving retail payments landscape, it is important that smaller or new firms can grow their retail payments innovation with less intense oversight (given their limited risk magnitude) and that oversight activities focus on those payment players that are of higher overall relevance or systemic importance. Still, even the smaller or new firms are explicitly invited to adhere to oversight requirements and should have the ambition to do so.

The Eurosystem oversees all euro area retail payment systems in euro. This includes retail payment systems that are systemically relevant and classified as SIPS, prominently important retail payment systems or other retail payment systems.[26] SIPS need to comply with the SIPS Regulation, which sets out stringent, legally binding requirements and describes the tools used by the Eurosystem to exercise its powers (including possible on-site visits to gain direct insight and the use of penalties in severe cases of infringement). In turn, non-systemically important retail payment systems need to meet fewer but still important requirements based on a moral suasion oversight approach.

In light of a changing retail payments ecosystem, the payment systems that are candidates for oversight are regularly reviewed. This has, for instance, led to the inclusion of instant payment systems and card payment systems under Eurosystem oversight. As another example, the so-called transfer function of a stablecoin arrangement (referred to in the EU Markets in Crypto-Assets Regulation, MiCAR, as “e-money tokens” and “asset-referenced tokens”) may fall under Eurosystem oversight. Moreover, in its oversight role, the Eurosystem also assesses links between retail payment systems, e.g. links to facilitate cross-border retail payments.

In 2021 the Eurosystem introduced the new oversight framework for electronic payment instruments, schemes and arrangements (PISA).[27] The PISA framework establishes a set of harmonised oversight principles, based on international standards, to assess the safety and efficiency of electronic payment instruments, schemes and arrangements. It replaced the former Eurosystem oversight approach and oversight standards for payment instruments. The PISA framework is future proof and agile, and a response to developments in the retail payments market. Its scope embraces all common retail payment instruments, as well as the payment schemes that are managed by a governance body, which sets the rules enabling end users to make a payment with an electronic payment instrument. Examples of such payment schemes are card payment schemes, e-money schemes, digital payment token schemes and credit transfer schemes. PISA oversight also includes payment arrangements, which are a set of operational functionalities that support end users in using an electronic payment instrument. An example of this is digital payment wallets. The PISA exemption policy provides that only those PISA entities relevant overall for the payment system are overseen, while others are either monitored or exempted.[28]

The Eurosystem as overseer places a strong focus on digital operational resilience.[29] Digital operational resilience is closely interrelated to digitalisation. In 2018 the Eurosystem developed its cyber resilience strategy for financial market infrastructures, which also applies to retail payment systems. Its key elements are: (i) assessments of overseen entities against detailed cyber resilience oversight expectations (CROE), (ii) regular cyber surveys to assess the level of cyber posture of overseen entities, and (iii) a framework for threat-led penetration testing. The framework, called Threat-Intelligence Based Ethical Red-teaming (TIBER-EU), is used to test the resilience of entities against cyberattacks in a real but controlled set-up. While not part of the oversight toolkit, the strategy also includes a pillar on regulator-industry engagement, under which the Euro Cyber Resilience Board for pan-European market infrastructures (ECRB) was established. The ECRB brings together industry and regulators in a trusted group setting, and under its auspices (but free from oversight/regulatory scrutiny) a framework for cyber intelligence and information sharing across ECRB market infrastructures was established (the Cyber Information and Intelligence Sharing Initiative (CIISI-EU)). For information and communications technology (ICT) service providers, the Eurosystem requires each overseen entity to identify and carefully manage the third-party ICT service providers it uses. Moreover, overseers are interested in identifying third-party ICT service providers that are critical for the payment system overall. They therefore run regular surveys to identify service providers and oversee the critical ones directly or indirectly.

The analysis of retail payment fraud is a further example of the oversight response to the evolving payments ecosystem. In recent years the analysis has focused on card payment fraud but it is now expanding to include other retail payment instruments given the availability of more data.[30] This activity helps overseers understand trends and support the development of suitable measures to reduce fraud, acting alongside other authorities and legislators as appropriate. A recent example of a successful measure was the implementation of Strong Customer Authentication, which was introduced as part of the revised EU Payment Services Directive.[31]

The need to ensure continued access to public money

The Eurosystem is committed to ensuring that people retain the freedom of choice in their use of payment instruments and especially continued access to public money in the form of cash. As outlined in Box 1, despite a gradual decline in the use of cash, cash remains a key method of payment at the point of sale and for person-to-person payments. A majority of consumers have also expressed the wish to have cash as a payment option.[32] The Eurosystem cash strategy aims to ensure that cash remains widely available and accepted as both a means of payment and a store of value.[33] Several efforts to monitor the adequacy of access to cash have been ongoing at the euro area and national levels, including the development and continued improvement of a common Eurosystem methodology to measure access to cash.[34] In this regard, the Eurosystem welcomes the European Commission proposal for a regulation on the legal tender of euro banknotes and coins.[35]

Given the growing trend of digitalisation, the Eurosystem is working on a digital euro in order to be prepared to make public money available to people and businesses in a digital form, alongside cash. A digital euro would offer people an additional option to pay with an electronic equivalent of cash. It would also ensure that public money remains available despite the growing digitalisation of payments. A digital euro would complement cash and not replace it. After an investigation phase analysing how a digital euro could be designed and distributed, as well as the impact it could have on the market, in November 2023 the Eurosystem launched a preparation phase to lay the foundations of a potential digital euro.[36] The first stage of the preparation phase should allow the finalisation of some conceptual elements of a digital euro and the preparation of the development and experimentation of its architecture. On the basis of the findings of this work, which is expected to last two years, and of the development of the digital euro legislative framework, the Eurosystem will decide on whether to go ahead with a second stage. The launch of the preparation phase does not, however, preclude a Eurosystem decision on whether to issue a digital euro. It merely aims to ensure that the Eurosystem is prepared in the event a decision to go ahead is made.

The digital euro project is complementary to cash but also to the development of a market-led pan-European payment solution for the point of interaction and the further strengthening of “classic” SEPA. This combined approach reflects the needs to achieve strategic autonomy in retail payments, to make retail payments more resilient by ensuring choice and to cater for varying use cases and user preferences. A digital euro could contribute to the goals of the Eurosystem’s retail payments strategy in multiple ways. For instance, it would offer a pan-European payment solution, making as much use as possible of existing industry standards, components and technology, and thereby be instrumental for private payment solutions to achieve pan-European reach and expand their use cases.

4 Going forward

The trends currently at work in the euro retail payments market will likely further accelerate, requiring the Eurosystem to remain vigilant to ensure the safety and efficiency of retail payments and the access to public money under diverse scenarios. This will mean following the Eurosystem’s retail payments strategy and applying active monitoring. It also means applying continuous oversight to individual overseen entities, identifying payment trends and ensuring that the oversight frameworks remain fit for the changing ecosystem and that oversight requirements are thoroughly implemented. The Eurosystem will also continue its work on the digital euro project to be in a position to issue a digital euro if the need arises.

In carrying out these activities, the Eurosystem will continue to interact with stakeholders and, where relevant, will further reinforce exchanges and collaboration with relevant fora and market players. The Eurosystem has established two high-level groups, bringing together relevant players to foster an integrated, innovative and competitive euro retail payments market – along with the ERPB – and to raise awareness, catalyse joint initiatives and share best practices on cyber resilience – together with the ECRB. In addition to this structured interaction, input is sought from market players other than the traditional players in the payments market. The Eurosystem has notably stepped up its interactions with fintechs, organising dedicated dialogues on selected topics.

The Eurosystem cooperates with other central banks and relevant authorities worldwide, given the global nature of the developments and use cases. International standards and cooperation are key in addressing the changing payments ecosystem. Through its participation in international fora such as the CPMI, hosted by the Bank for International Settlements, the ECB actively contributes to the development of international standards. International cooperation is also important to commonly oversee internationally active payment entities and thus ensure that the needs of each jurisdiction concerned are taken on board and regulatory arbitrage is avoided.

-

See Panetta, F., “Extending the benefits of digital technologies to cross-border payments”, The ECB Blog, ECB, 31 October 2023.

-

The ECB digital euro glossary defines the point of sale as “A physical place at which goods and services are sold and paid for, such as shops and restaurants”.

-

See (i) Regulation (EU) 2023/1114 of the European Parliament and of the Council of 31 May 2023 on markets in crypto-assets, and amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EU and (EU) 2019/1937 (OJ L 150, 9.6.2023, p. 40); (ii) Regulation (EU) 2022/2554 of the European Parliament and of the Council of 14 December 2022 on digital operational resilience for the financial sector and amending Regulations (EC) No 1060/2009, (EU) No 648/2012, (EU) No 600/2014, (EU) No 909/2014 and (EU) 2016/1011 (OJ L 333, 27.12.2022, p. 1); and (iii) Proposal for a Regulation of the European Parliament and of the Council amending Regulations (EU) No 260/2012 and (EU) 2021/1230 as regards instant credit transfers in euro (COM/2022/546).

-

See, for instance, the article entitled “Central bank money settlement of wholesale transactions in the face of technological innovation”, Economic Bulletin, Issue 8, ECB, 2023.

-

See the Financial Stability Board’s website at www.fsb.org.

-

See Panetta, F., “Caveat emptor does not apply to crypto”, The ECB Blog, ECB, 5 January 2023.

-

See Panetta, F., “Adapting to the fast-moving cyber-threat landscape: no room for complacency”, introductory remarks at the seventh meeting of the Euro Cyber Resilience Board for pan-European Financial Infrastructures, Frankfurt, 1 June 2022.

-

See “Study on the payments attitudes of consumers in the euro area (SPACE)”, ECB, December 2022.

-

Regulation (EU) No 260/2012 of the European Parliament and of the Council of 14 March 2012 establishing technical and business requirements for credit transfers and direct debits in euro and amending Regulation (EC) No 924/2009. The new pan-European schemes replaced the national ones in the euro area on 1 August 2014.

-

See “Cards payments in Europe – current landscape and future prospects”, ECB, April 2019.

-

See “Implications of digitalisation in retail payments for the Eurosystem’s catalyst role”, ECB, July 2019.

-

See Couré, B., “Towards the retail payments of tomorrow: a European strategy”, speech at the Joint Conference of the ECB and the Nationale Bank van België/Banque Nationale de Belgique on “Crossing the chasm to the retail payments of tomorrow”, Brussels, November 2019.

-

See “ECB welcomes initiative to launch new European payment solution”, press release, ECB, 2 July 2020; and “ECB welcomes the EPI’s progress on building a European payment solution”, MIP News, ECB, 25 April 2023.

-

It is noted that other initiatives, for instance relying on interoperability, aim to meet the key objectives of the Eurosystem’s retail payments strategy.

-

See Panetta, F., “On the edge of a new frontier: European payments in the digital age”, speech at the ECB Conference “A new horizon for pan-European payments and digital euro”, Frankfurt am Main, October 2020.

-

For further information on the ERPB (mandate, composition, meeting documentation, statements, etc.), see the ERPB web page on the ECB’s website.

-

For instant payments, this is the scheme for SEPA instant credit transfers in euro referred to earlier in the article. For open banking, it is the SEPA Payment Account Access Scheme.

-

See “The Eurosystem’s retail payments strategy – priorities for 2024 and beyond”.

-

See “Central bank oversight of payment and settlement systems”, Committee on Payment and Settlement Systems, Bank for International Settlements, May 2005.

-

See “Revised oversight framework for retail payment systems”, ECB, February 2016. Retail payment systems are formal arrangements for the transmission, clearing and/or settlement of monetary obligations arising between their members based on payments made by their clients.

-

See “Eurosystem oversight framework for electronic payment instruments, schemes and arrangements”, ECB, November 2021.

-

Regulation of the European Central Bank (EU) No 795/2014 of 3 July 2014 on oversight requirements for systemically important payment systems (OJ L 217, 23.7.2014, p. 16).

-

Formerly known as the Committee on Payment and Settlement Systems (CPSS).

-

See “Principles for financial market infrastructures”, CPSS-IOSCO, April 2012.

-

See “Application of the Principles for Financial Market Infrastructures to stablecoin arrangements”, CPMI-IOSCO, July 2022.

-

For an overview of the payment systems subject to oversight, see the payment systems web page on the ECB’s website.

-

See “The Eurosystem oversight framework for electronic payments (PISA) is published”, MIP News, ECB, 22 November 2021.

-

For an overview of the payment schemes and arrangements subject to oversight, see the payment schemes and arrangements web page on the ECB’s website

-

For further information, see the cyber resilience and financial market infrastructures web page on the ECB’s website.

-

See “Report on card fraud in 2020 and 2021”, ECB, May 2023.

-

Directive (EU) 2015/2366 of the European Parliament and of the Council of 25 November 2015 on payment services in the internal market amending Directives 2002/65/EC, 2009/110/EC and 2013/36/EU and Regulation (EU) No 1093/2010, and repealing Directive 2007/64/EC (OJ L 337, 23.12.2015, p. 35).

-

See the article entitled “Is there a digital divide in payments? Understanding why cash remains crucial for many”, Economic Bulletin, ECB, 2024, forthcoming.

-

See the Eurosystem cash strategy web page on the ECB’s website.

-

See the article entitled “Guaranteeing freedom of payment choice: access to cash in the euro area”, Economic Bulletin, Issue 5, ECB, 2022.

-

See “Opinion of the European Central Bank of 13 October 2023 on a proposal for a regulation on the legal tender of euro banknotes and coins (CON/2023/31)”, ECB, October 2023.

-

See “Eurosystem proceeds to next phase of digital euro project”, press release, 18 October 2023; and the digital euro web page on the ECB’s website.

Related topics

Poslední zprávy z rubriky Makroekonomika:

Přečtěte si také:

Prezentace

18.12.2024 Apple iPad je rekordně levný, vyjde teď jen na 8

17.12.2024 Začínáte s kryptoměnami? Binance je ideálním…

Okénko investora

Radoslav Jusko, Ronda Invest

AI, demografie a ženy investorky. Investiční trendy pro rok 2025

Miroslav Novák, AKCENTA

ČNB v prosinci přerušila, nikoliv však zastavila cyklus uvolňování měnové politiky

Petr Lajsek, Purple Trading

John J. Hardy, Saxo Bank

Šokující předpověď - Nvidia dosáhne dvojnásobku hodnoty Applu

Olívia Lacenová, Wonderinterest Trading Ltd.

Mgr. Timur Barotov, BHS

Ali Daylami, BITmarkets

Jakub Petruška, Zlaťáky.cz

S návratem Donalda Trumpa zlato prudce klesá. Trhy zachvátila pozitivní nálada

Jiří Cimpel, Cimpel & Partneři

Portfolio 60/40: Nadčasová strategie pro dlouhodobé investory