Contingent liabilities and non-performing loans in 2023

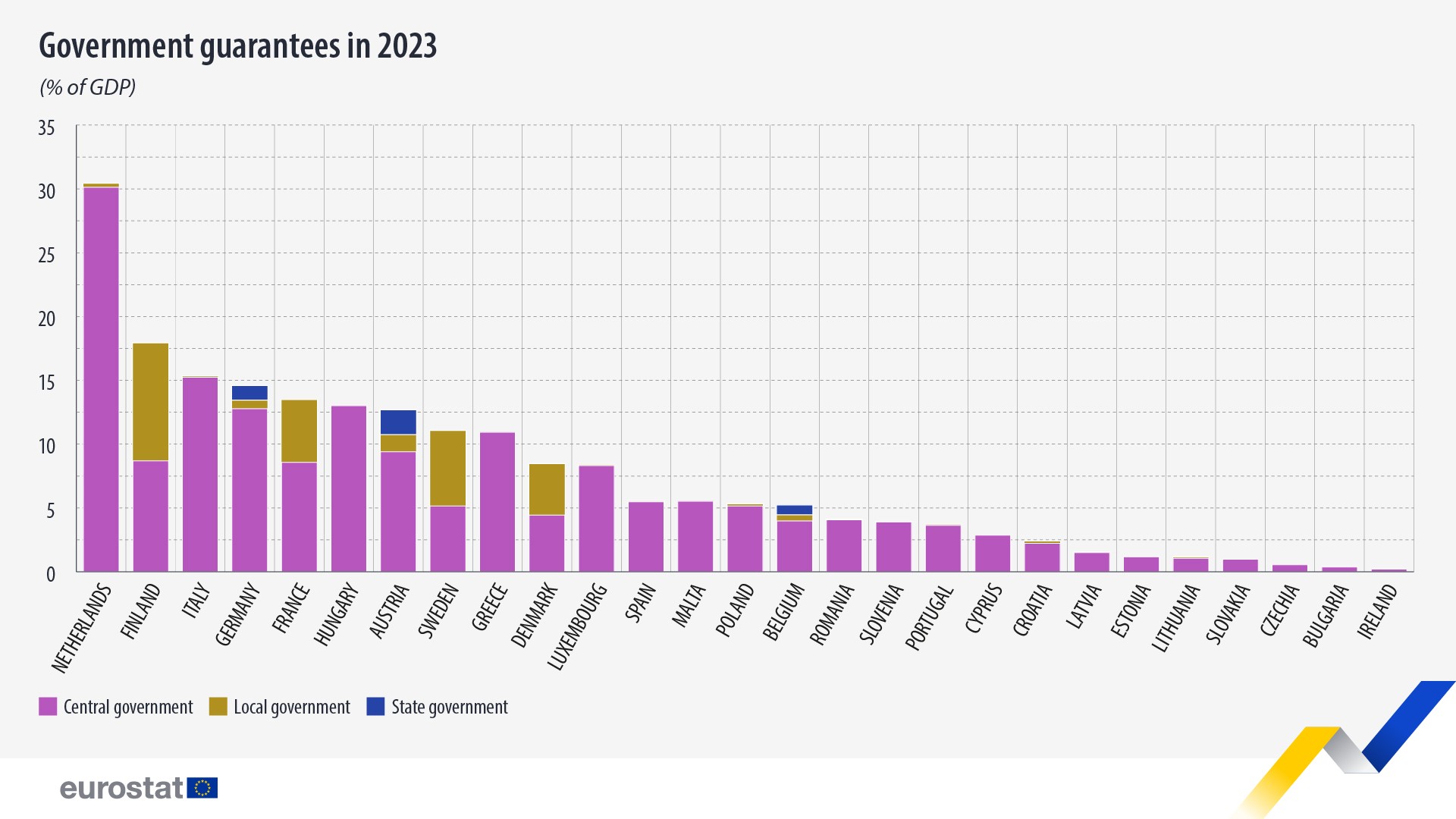

The most common form of contingent liabilities in the EU countries is government guarantees on liabilities, and occasionally on assets of third parties. In 2020 and 2021, government guarantees, provided in the EU, increased substantially following the onset of the COVID-19 pandemic. In 2022, the level of government guarantees was further influenced by the energy crisis following Russia’s war of aggression against Ukraine. In 2023, there was a decrease of guarantees in most of the EU countries.

In 2023, the highest overall rate of government guarantees was recorded in the Netherlands (30.4% of GDP), Finland (17.9%), Italy (15.3%), Germany (14.6%) and France (13.5%). On the lower end of the scale, rates equal to or less than 1% of GDP were recorded in Ireland, Bulgaria, Czechia and Slovakia.

This information comes from data on contingent liabilities and non-performing loans published by Eurostat today. This article presents a handful of findings from the more detailed Statistics Explained article on contingent liabilities and non-performing loans.

Source dataset: gov_cl_guar

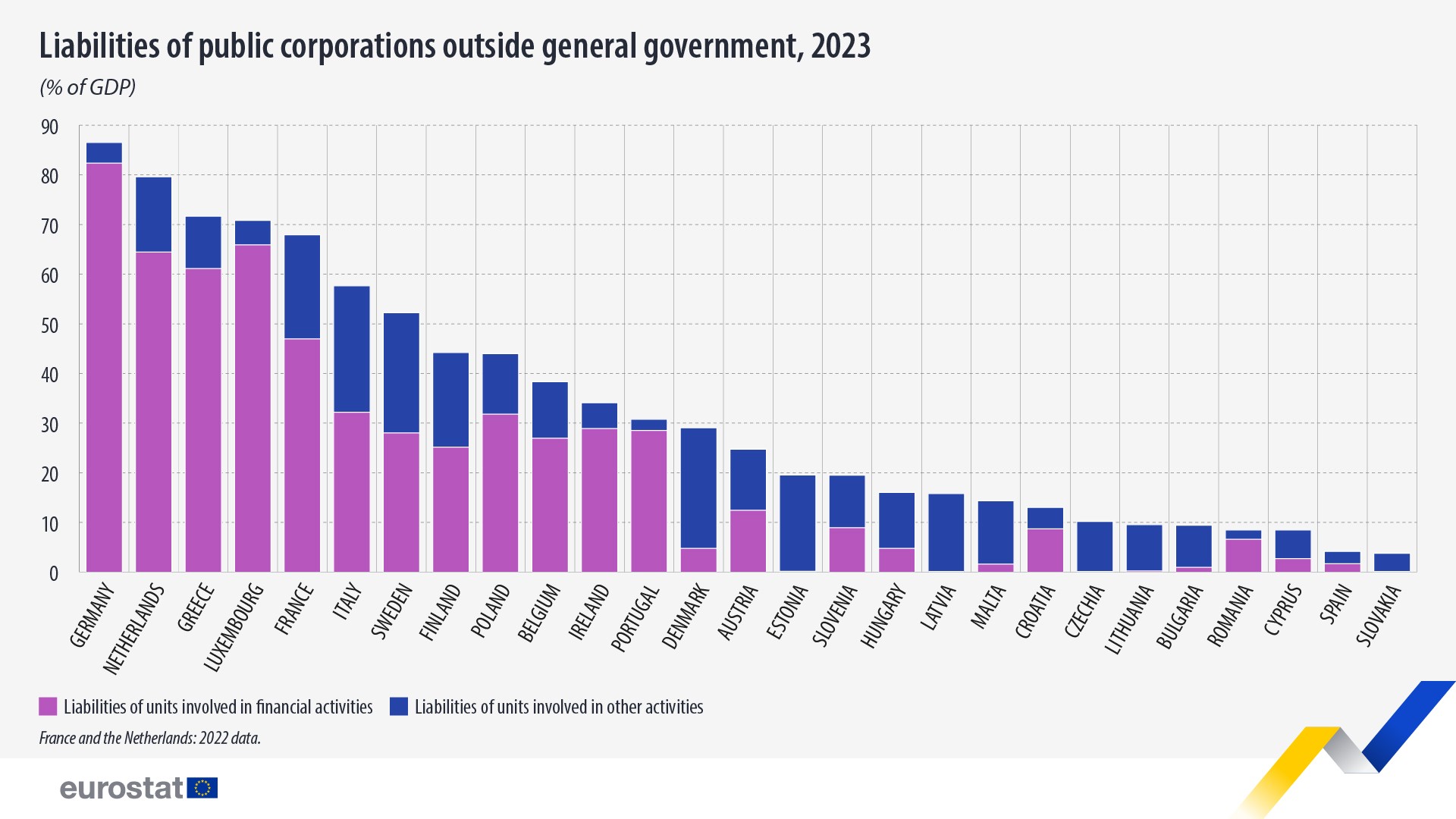

Liabilities of public corporations highest in Germany

The level of public corporations’ liabilities classified outside general government in 2023 varied widely across EU countries. Significant amounts of liabilities were recorded in Germany (86.5% of GDP), ahead of the Netherlands (79.5%) and Greece (71.7%).

In contrast, the lowest liabilities of public corporations were recorded in Slovakia (3.7%), Spain (4.1%) and Cyprus (8.4%).

Source dataset: gov_cl_liab

Highest level of non-performing loans in Cyprus

In 2023, Cyprus was the country with the highest stock of non-performing loans (assets) of the general government, at 11.8% of GDP, followed by Croatia with a share of 0.9% and Spain 0.5%. For the remaining countries, the amounts were either very low or nearly zero.

Off-balance public-private partnerships liabilities: highest in Portugal

Liabilities related to off-balance public-private partnerships (PPPs) refer to long-term construction contracts where assets are recorded outside government accounts. In 2023, these were below 2% of GDP in all EU countries and 9 EU countries had no such liabilities. Portugal had the highest share (1.4% of GDP), followed by Slovakia (1.1%) and Latvia (0.7%). These PPP liabilities are predominantly due to motorway projects.

For more information

- Statistics Explained article on contingent liabilities and non-performing loans

- Statistics 4 Beginners on government finance statistics

- Thematic section on government finance statistics

- Database on government finance statistics

Methodological notes

- Data on contingent liabilities and potential obligations of government are provided by the EU countries in the context of the Enhanced Economic Governance package (the "six-pack") adopted in 2011. In particular, Council Directive 2011/85 amended by new Council Directive 2024/1265 on requirements for budgetary frameworks of the Member States requires the EU countries to publish relevant information on contingent liabilities with potentially large impacts on public budgets, including government guarantees, non-performing loans, and liabilities stemming from the operation of public corporations, including the extent thereof.

- Contingent liabilities are not part of the general government (Maastricht) debt, as defined in the Council Regulation (EC) No 479/2009 of 25 May 2009 on the application of the Protocol on the excessive deficit procedure annexed to the Treaty establishing the European Community.

- According to the decision of Eurostat from 2013, contingent liability data are reported by the EU countries annually each December, with a typical time lag of T+12 months. The current article, therefore, occurs with a time lag of T+13 months.

-

This article includes data on contingent liabilities (potential liabilities) which may become actual government liabilities if some specific conditions prevail. It covers:

- government guarantees;

- liabilities of government-controlled entities (public corporations) classified outside general government;

- government non-performing loans (NPLs, assets), which could imply a loss for the government if these loans are not repaid;

- liabilities related to public-private partnerships (PPPs) recorded off-government-balance-sheet.

-

Data on guarantees do not include:

- government guarantees issued within the guarantee mechanism under the Framework Agreement of the European Financial Stability Facility (EFSF) and the European Stability Mechanism (ESM);

- derivative-type guarantees meeting the European system of national and regional accounts (ESA 2010) definition of a financial derivative;

- deposit insurance guarantees and comparable schemes;

- government guarantees issued on events that are difficult to cover via commercial insurance (earthquakes, large-scale flooding, etc.).

- The data for liabilities of government-controlled entities classified outside general government in this article refer to reference year 2023 (with a few minor exceptions). France and the Netherlands: 2022 instead of 2023 for data on the level of liabilities of public corporations classified outside general government.

- Off-balance sheet PPPs data do not include the liabilities related to off-balance sheet concession contracts, as per the concession definition in Chapter 2 of the Guide to the Statistical Treatment of PPPs.

If you have any queries, please visit our contact us page.