Faster green transition would benefit firms, households and banks, ECB economy-wide climate stress test finds

- PRESS RELEASE

Faster green transition would benefit firms, households and banks, ECB economy-wide climate stress test finds

6 September 2023

- Frontloading green investment significantly reduces medium-term costs and risks facing households and firms

- Not expediting green transition drags down firms’ profitability and households’ purchasing power while pushing up credit risk for banks

- Further delaying transition means missing Paris Agreement goals and exacerbating impact of costly physical risks

The European Central Bank (ECB) today published the results of its second economy-wide climate stress test. The results show that the best way to achieve a net-zero economy for firms, households and banks in the euro area is to accelerate the green transition to a rate that is faster than under current policies.

“We need more decisive policies to ensure a speedier transition towards a net-zero economy in line with the goals of the Paris Agreement. Moving at the current pace will push up risks and costs for the economy and financial system. There is a clear need for speed on the road to Paris,” says ECB Vice-President Luis de Guindos.

The stress test analyses the resilience of firms, households and banks to three transition scenarios, which differ in terms of timing and ambition:

- an “accelerated transition”, which frontloads green policies and investment, leading to a reduction in emissions by 2030 in line with the goals of the Paris Agreement;

- a “late-push transition”, which continues on the current path, but does not speed up until 2026 (and is still intense enough to achieve Paris-aligned emission reductions by 2030);

- a “delayed transition”, which also starts only in 2026, but is not sufficiently ambitious to reach the Paris Agreement goals by 2030.

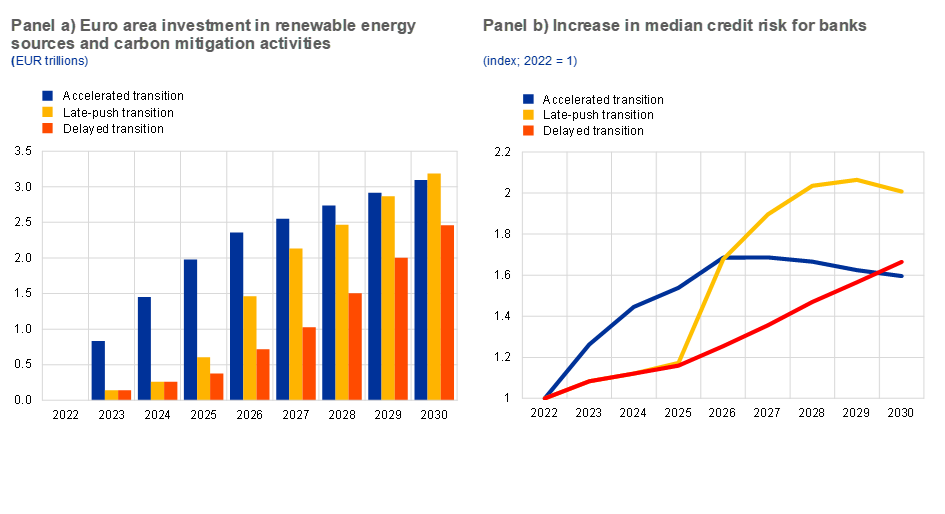

The results show that firms and households clearly benefit from a faster transition. While a speedier transition initially involves greater investment and higher energy costs, financial risks decrease significantly in the medium term. Both profits and purchasing power are less negatively affected as the frontloaded investment in renewable energy pays off earlier and ultimately reduces energy expenses. In the accelerated transition, green investment by euro area firms rises to €2 trillion by 2025, while amounting to only €0.5 trillion in the other two scenarios. In the late-push transition, green investment catches up with the accelerated transition by 2030, as they both reach a total of €3 trillion, while it remains lower in the delayed transition. For it to catch up, green investment needs to be increased swiftly, putting firms at higher risk, particularly in energy-intensive sectors such as manufacturing, mining and electricity, with debt levels rising and profits falling around twice as much as for the average euro area firm.

If firms are at risk, so are the banks that lend to them. Banks are exposed to the highest credit risk if the transition has to be rushed at a later stage and investment is required quickly at higher costs. In the late-push transition, banks can expect their credit risk to rise by more than 100% by 2030 compared with 2022, while in the accelerated transition, the increase is only 60%.

Moreover, delaying the transition, and not acting at all, leads to even higher costs and risks in the long run. While it entails less investment overall, missing emission reduction targets exacerbates the impact of physical risk on the economy and the financial sector significantly.

Chart 1

More ambitious emission reduction targets driven by timely and intensive investment lead to lower credit risk for banks in the medium term

Source: ECB calculations based on Orbis, Urgentem, Eurostat, Network for Greening the Financial System, Broad Macroeconomic Projection Exercise (BMPE) projections, International Renewable Energy Agency (IRENA, 2021) and Intergovernmental Panel on Climate Change (IPCC, 2022) data.

Notes: Panel a) displays euro area cumulative investment across time, representing the debt acquired by euro area firms in each scenario between 2023 and 2030. Panel b) presents median corporate loan portfolio probabilities of default for significant institutions in the euro area.

The second economy-wide climate stress test follows up on the results of the first economy-wide stress test exercise published in September 2021. It complements the ECB Banking Supervision climate stress test, which analysed risks for individual banks from a bottom-up perspective in July 2022, by having a wider scope and looking at firms, households and the banking sector from a top-down perspective. The ECB’s economy-wide climate stress is part of its climate agenda and ongoing work to improve understanding of climate-related risk.

For media queries, please contact Clara Martín Marqués, tel.: +49 69 1344 17919.

Related topics

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contactsPoslední zprávy z rubriky Evropská unie:

Přečtěte si také:

Příbuzné stránky

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 5 dnů - měna EUR

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 2 dny - měna EUR

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 3 měsíce - měna EUR

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 1 rok - měna CZK

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 2 dny - měna USD

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 1 den - měna CZK

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 3 roky - měna CZK

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 5 dnů - měna USD

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 3 roky - měna USD

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 10 let - měna USD

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 2 roky - měna USD

- Sweat Economy - aktuální a historické ceny kryptoměny Sweat Economy, graf vývoje ceny kryptoměny Sweat Economy - 1 rok - měna USD

Prezentace

25.11.2024 Zkontrolujte, zda je vaše nemovitost dobře…

25.11.2024 Pochybujete o crowdfundingu? Vsaďte na lepší…

22.11.2024 Výsledková sezóna: Obhájila Nvidia svou…

Okénko investora

Petr Lajsek, Purple Trading

Zmatek na ropném trhu. Jak se promítne do cen pohonných hmot?

Ali Daylami, BITmarkets

Olívia Lacenová, Wonderinterest Trading Ltd.

Elektrické návěsy od Range Energy: Klíč k udržitelnější kamionové dopravě?

Mgr. Timur Barotov, BHS

Radoslav Jusko, Ronda Invest

Dvojnásobný růst prodeje bytů oproti loňsku: Co to znamená pro ceny?

Jakub Petruška, Zlaťáky.cz

S návratem Donalda Trumpa zlato prudce klesá. Trhy zachvátila pozitivní nálada

Miroslav Novák, AKCENTA

Jiří Cimpel, Cimpel & Partneři

Portfolio 60/40: Nadčasová strategie pro dlouhodobé investory