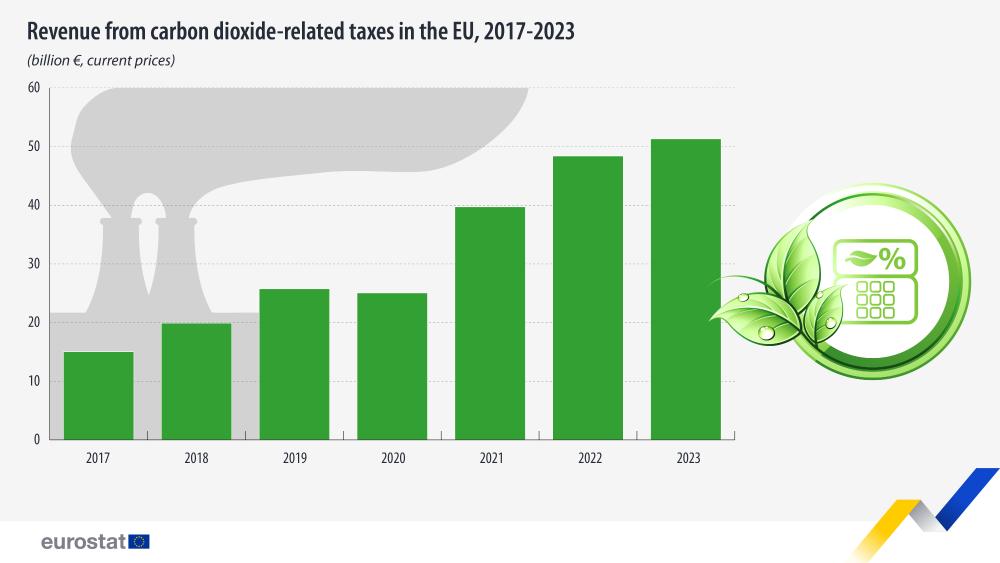

Carbon taxes revenue tripled between 2017 and 2023

Between 2017 and 2023, the revenue from carbon dioxide related taxes in the EU increased strongly, growing from €15 billion to €51 billion. Carbon (dioxide) taxes are levied on the carbon content of fossil fuels. Their share in the overall energy taxes increased from 6.0% in 2017 to 19.7% in 2023.

Source dataset: env_ac_taxind2

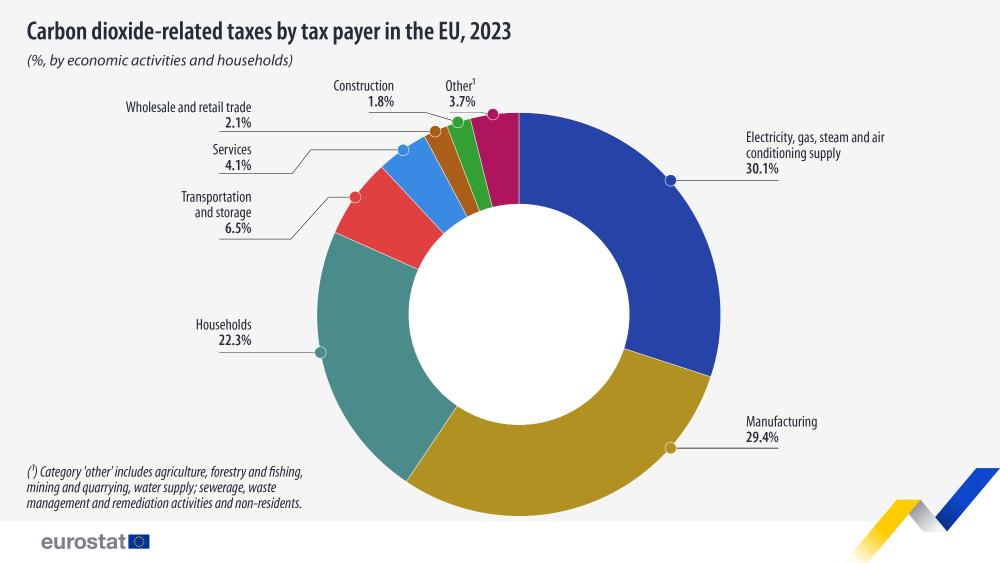

In 2023, more than three-quarters (76.4%) of the carbon taxes were collected from businesses, while households contributed 22.3% and non-residents 1.3%. The energy sector (supply of electricity, gas, steam and air conditioning) contributed 30.1% of total carbon taxes, followed closely by manufacturing, which accounted for 29.4%.

Source dataset: env_ac_taxind2

For more information

- Statistics Explained article on climate-related taxes

- Statistics on climate change mitigation - online publication

- Thematic section climate change

- Thematic section on environment

- Database on environment

- Environmental taxes – A statistical guide – 2024 edition

- Environmental accounts dashboard

- Statistics for the European Green Deal - visualisation

Methodological note

- Carbon dioxide–related taxes or carbon taxes are levied on the carbon content of fossil fuels and also include taxes on other greenhouse gas emissions. Government revenues from the auctioning of emissions permits under the EU Emissions Trading Scheme are included as a subset of carbon taxes.

- The breakdown of carbon dioxide–related taxes by economic activity is based on the statistical classification of economic activities in the European Community (NACE).

For information on upcoming releases visit our release calendar. If you have any queries, please visit our contact us page.