The increasing energy demand of artificial intelligence and its impact on commodity prices

The increasing energy demand of artificial intelligence and its impact on commodity prices

Prepared by Vlad Burian and Arthur Stalla-Bourdillon

Published as part of the ECB Economic Bulletin, Issue 2/2025.

The adoption of artificial intelligence (AI) models has surged across the globe, requiring substantial computing power. AI-related energy consumption in data centres is currently limited, estimated at around 20 terawatt-hours (TWh) or 0.02% of global energy consumption.[1] However, AI models are increasingly being used to develop intelligent applications, ranging from AI assistants to self-driving vehicles. Generative AI models, particularly those used for creating text and image-based content, require large amounts of power in terms of both training and operation. For example, a single query on ChatGPT3 uses roughly ten times more energy than a typical Google search.[2] With the development of newer and more computationally intensive large language models (LLMs), the related energy demand is expected to grow further.[3]

There is already a clear link between increased use of AI and energy consumption. Energy consumption among the “Magnificent Seven” – the seven largest US tech companies, including Alphabet and Microsoft – and data centre firms has grown much faster than that of S&P 500 companies, a development potentially linked to the rising use of AI. Changes in annual energy consumption in 2023 reveal that, while the median energy consumption of S&P 500 companies remained flat, it rose significantly for the Magnificent Seven and data centre firms, by 19% and 7% respectively.

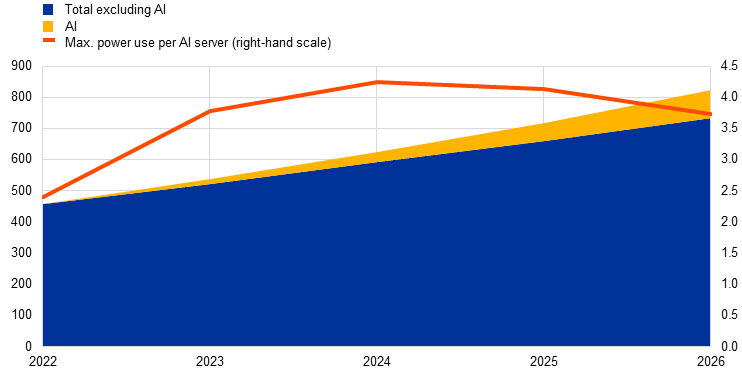

Looking ahead, the surge in AI-related energy demand is projected to persist, with an uneven distribution across countries. Although there is much uncertainty about future AI adoption, the International Energy Agency (IEA) projects that data centres, both AI-driven and non-AI-driven, could use 80% more energy in 2026 than in 2022, even taking into account efficiency gains (Chart A).[4] More specifically, the electricity consumption of AI-driven data centres is expected to rise by 90 TWh, contributing 20 percentage points to the overall growth in data centre energy consumption. This is equivalent to around 4% of the EU’s current electricity consumption. According to the IEA, data centre energy consumption, covering both AI and non-AI applications, is projected to grow most rapidly in China and the United States, rising by 70 TWh and 60 TWh respectively.

Chart A

Projected growth in the electricity demand of data centres

(left-hand scale: terawatt-hours; right-hand scale: kilowatts)

Sources: IEA, Goldman Sachs and ECB staff calculations.

Notes: AI electricity demand between 2022 and 2026 is linearly interpolated with values for 2026 taken from IEA forecasts. The orange line shows the projected maximum power use of an AI server, highlighting expected efficiency gains.

The rise in AI-related energy demand is expected to be met by natural gas power plants or renewables. Regulatory efforts to reduce carbon footprints are driving companies to prioritise carbon-neutral energy options, particularly renewables. Tech giants are also exploring alternatives such as new nuclear power plants, but neither solutions involving partnerships with new large facilities nor those involving acquisition of dedicated small modular reactors are likely to be up and running before 2026. In the event of electricity shortfalls, natural gas is expected to supplement renewables, as it is less polluting than coal. Two polar and extreme scenarios could therefore be considered: one in which all energy demand is met by natural gas, and another in which it is covered entirely by renewables.

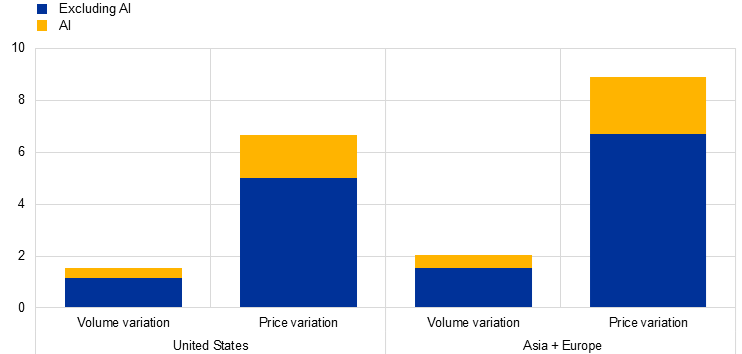

Even under the first scenario assuming that the electricity demand of AI-driven data centres is fully met with natural gas, the impact on gas prices is limited. By scaling the IEA’s estimated data centre energy demand to the size of the US gas market and the size of the Asian and European gas markets combined, and then applying elasticities from the literature, it is found that gas prices could rise by around 9% in Asia and Europe, and by 7% in the United States (Chart B).[5] Moreover, AI-driven data centres would account for around 2 percentage points of the increase in both the Asian-European market and the US market. AI adoption is therefore expected to put only limited upward pressure on gas prices. This is because the AI-related energy demand shock – even under this extreme scenario – is minimal relative to the overall size of the US and Asian-European gas markets, despite being large in absolute terms.

Chart B

Estimated gas demand and gas price variation when all data centre energy demand is met with natural gas by 2026

(percentages)

Sources: IEA and ECB staff calculations.

Notes: The figures are based on IEA projections for future data centre energy demand, assuming that all additional energy needs during the period from 2022 to 2026 are met by gas power plants. Data centre energy demand is converted to gas demand using a conversion rate of 45% (see “More than 60% of energy used for electricity generation is lost in conversion”, Today in Energy, U.S. Energy Information Administration, 21 July 2020). AI-related energy demand for each region is estimated by assuming a constant share of AI-related electricity consumption in the total data centre electricity consumption across both regions.

Under the second scenario, in which the additional energy demand is covered by renewables, demand for critical minerals increases, but their prices are unlikely to be affected significantly as a result. Critical materials, such as lithium and nickel, are essential for wind farms and solar panels. They are already in high demand due to the energy transition, and their mining is highly concentrated in specific countries, which makes them particularly vulnerable to supply chain disruptions and geopolitical tensions.[6] However, like natural gas, and unlike electricity, these minerals are relatively easy to transport across regions. As a result, the AI-related growth in demand is expected to be modest relative to the overall size of the market, so that upward price pressures specifically attributable to AI will be contained.

The surge in AI-related electricity demand could, however, create price pressures in national electricity markets. Owing to limited interconnection capacities and energy loss during transmission, electricity markets consist of multiple submarkets that are relatively isolated. As a result, countries such as Ireland, which are big players in the data centre sector, may find it particularly challenging to meet the growing AI-related demand locally. The overall potential impact on national electricity markets is more difficult to estimate, however, as it will depend on the concentration of AI-driven data centres in each country, the specific characteristics of their markets and the regulatory requirements for data centres to contribute to the power supply.

See “World Energy Outlook 2023”, International Energy Agency, October 2023.

De Vries, A., “The growing energy footprint of artificial intelligence”, Joule, Vol. 7, No 10, October 2023, pp. 2191-2194.

AI-related energy demand is expected to increase even though the licence fees for some LLMs are charged per query, which could result in lower usage relative to free-of-charge models.

See “Electricity 2024”, International Energy Agency, January 2024. The IEA expects not only AI, but also cloud computing and cryptocurrencies to be major drivers of data centre electricity consumption.

The elasticities used are taken from Albrizio, S. et al., “Sectoral Shocks and the Role of Market Integration: The Case of Natural Gas”, AEA Papers and Proceedings, Vol. 113, May 2023, pp. 43-46.

Adolfsen, J.F., Kedan, D. and Lappe, M-S., “The geopolitics of green minerals”, The ECB Blog, ECB, 10 July 2024.

Related topics

Disclaimer

Please note that related topic tags are currently available for selected content only.