What drives domestic inflation? The triangle of wages, profits and productivity

- THE ECB BLOG

What drives domestic inflation? The triangle of wages, profits and productivity

16 December 2024

By Stefan Gebauer, Thomas McGregor and Sebastiaan Pool

Though overall inflation has come down a lot, domestic inflation remains stubbornly high. This is typical for monetary policy tightening cycles. To understand why, The ECB Blog looks at how monetary policy is transmitted to wages, profits and productivity.

In response to surging inflation, the ECB decisively raised interest rates and tightened its policy stance. Inflation in the euro area has since fallen from its peak of 10.6% in October 2022 to 2.3% in November 2024. But while headline inflation, which includes the prices for imported goods such as oil and gas, has fallen quickly, domestic inflation, which is heavily influenced by prices for services, remains high at around 4%.

What are the reasons behind this difference? Domestic inflation is heavily influenced by the interactions between wages, profits and productivity. In this blog, we assess how these three elements of the “triangle” have responded to past monetary policy tightening. We find that the current situation is quite typical. This supports the December 2024 ECB staff projections that inflation will return to target at the end of 2025 and that the euro area economy is expected to recover steadily and adds confidence that the disinflationary process is on track.

Let’s take a closer look at the transmission mechanics on the triangle of wages, profits and productivity.

In response to higher interest rates, demand contracts because borrowing money for consumption and investment becomes more expensive and saving becomes more attractive. The dynamics of inflation, however, are not only driven by demand but crucially depend on how firms adjust their workforce to sustain productivity, pass on higher labour costs to their customers and manage profits over the business cycle. Typically, as demand recovers firms can expect to see a gradual recovery in productivity and profits, accompanied by a decline in labour costs. Together, these factors allow for a fall in the rate of inflation. This is precisely what we expected to see over the current policy cycle. Let’s look at these economic relationships in greater detail.

The interplay of wages, profits and productivity

The relationship between wages, productivity and profits influences inflation in various ways. Wages directly affect how much it costs a firm to produce goods and services. All else being equal, higher wages mean that production costs rise, which can lead firms to raise their prices. Productivity measures how much output each worker produces.[1] Higher productivity means that firms can produce more with the same number of workers. So, even if wages rise, higher productivity can help keep the overall cost per output unit – for instance per car that leaves the factory – from increasing too much. Profits reflect what is left after a firm pays all its costs, including wages, costs of raw material and other inputs and capital expenses. Profits thus represent the difference between the prices firms set for their goods and services and their production costs. Firms can accept lower profits to temporarily absorb fluctuations in their input costs, without changing the prices that they charge their customers.

Wages, productivity and profits are closely linked and evolve over time. In the long run, productivity is driven by innovation and investment in better equipment. In the short to medium-term, however, it is influenced more by how quickly firms can adjust their production levels and use of inputs, including the reliance on their workforce. For instance, if demand drops, but firms do not adjust their labour force, because they want to hold on to workers or are compelled to do so by fixed-term contracts, productivity falls. That is, the same number of workers now produce less. In such cases firms might absorb these higher costs rather than passing them on to consumers, which means their profits take a hit. This can temporarily cushion the impact of rising production costs on inflation.

Monetary policy transmission via the triangle

To get a better understanding of how monetary policy has affected wages, productivity, and profits in the past – and what this means for inflation – we use a method called local projections.[2] The challenge is that we cannot simply relate changes in policy to economic outcomes: causality can run in both directions. Policy is set based on the economic outlook, precisely because we think monetary policy can influence that outlook. We follow the standard practice in the literature and use short-term movements in market interest rates around ECB policy decisions. The idea is that changes in policy rates expected ahead of each decision should be fully priced in by markets, and so any market reaction to a decision reflects a surprise that cannot be explained by the current state of the economy.[3]

We measure the extent to which these unexpected changes in short-term interest rates affect the three transmission variables – wages (measured by total compensation per employee), labour productivity (output per hours worked) and profits (per unit of output produced) – controlling for macroeconomic and financial variables. Additionally, we also look at three other important macroeconomic variables: output, unemployment and core inflation.

The dynamics of inflation can change over the policy cycle

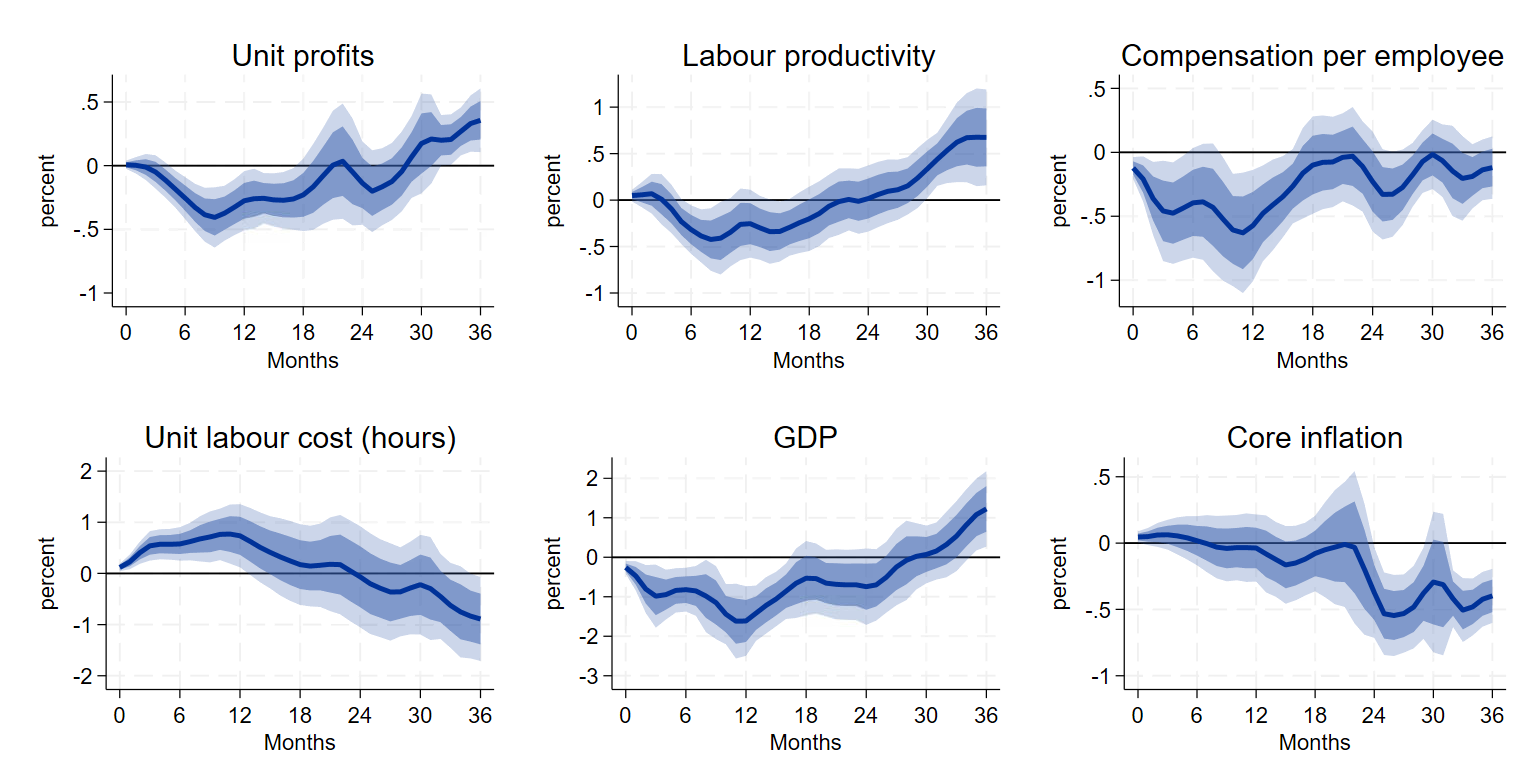

In the short run, productivity declines when monetary policy is tightened, as shown in Chart 1. This happens because demand and hence output decreases faster than employment can be adjusted, so firms end up producing less with the same number of workers. Initially, the inflationary effects from a drop in labour productivity is only partly balanced by a decrease in wages, leading to higher labour costs per unit of output for firms, or unit labour costs. As demand falls, firms cannot easily pass the increases in unit costs onto consumers via prices.[4] Firm profits thus absorb the initial increase in production costs resulting from a monetary tightening. The result is that inflation doesn’t respond much in the first year after a monetary policy tightening. Over time, firms slowly adjust their workforce down to the lower demand environment, while keeping wage growth contained. While the decline in household income reduces economic demand, it also improves labour productivity and production costs decrease. The decline in production costs therefore translates into lower prices, though with a delay. That, in turn, leads to a gradual decline in inflation.[5] During this period, firm profits remain low until demand starts to recover and firms can raise their prices again.[6]

Chart 1

Response of key macroeconomic variables to monetary policy shocks

Percent and percentage points

Source: Eurostat data and ECB calculations.

Notes: the chart shows the responses of unit profits, labour productivity, compensation per employee, unit labour costs, output (GDP) and core inflation (HICPx) to monetary policy shocks estimated using local projections. The controls include: two lags of the respective response variable, and the contemporaneous response and two lags of the ECB’s Composite Indicator of Systemic Stress (CISS) in financial markets, the commodity price index (all in log-levels), the 3-month OIS rate, a 10-year GDP-weighted synthetic sovereign bond yield, and the USD/EUR exchange rate. Shocks are identified by high frequency surprises in the 3mOIS around GovC using the ‘poor man’ sign restrictions as in Jarocinski and Karadi (2020). Impulse responses derived by local projections and scaled to a 25bps peak reaction in the 3 months OIS rate and smoothed by taking a 3 months moving average. The blue areas represent the 68 and 90% confidence intervals.

Latest observation: July 2024.

The findings from the local projections model used in our analysis are directionally consistent with the recent macroeconomic projections. This fits the pattern of an economic rebound about two years after a monetary policy tightening. The recovery is projected to lead to a cyclical boost in productivity and lower labour costs. According to the model, these developments should indeed allow firms to slow the pace of price increases as wage increases return to more moderate levels and profits recover.[7]

In a nutshell, the findings discussed in this blog post underscore the interplay between the triangle of wages, productivity, and profits in influencing inflation dynamics. These factors have played a crucial role in determining the impact of the recent tightening of monetary policy on inflation, and they will continue to be significant in shaping its trajectory. Overall, recent trends align with historical patterns, strengthening confidence that inflation is converging to the Governing Council’s two per cent target in a sustainable manner.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog

-

There are many ways to measure productivity. In this blog, we focus on a simple measure of labour productivity which takes the real value of output produced by firms divided by the total number of workers.

-

See Jorda, O. (2005). "Estimation and Inference of Impulse Responses by Local Projections." American Economic Review, 95(1), 161-182.

-

We also follow the approach of Jarociński and Karadi (2020) and focus on cases where the stock market reacts as expected to a change in monetary policy. By concentrating on situations where the stock market's reaction aligns with our expectations, we can be more confident that the change in monetary policy was unexpected.

-

In the economic literature, the mechanism of firms trying to pass on higher production costs associated with higher interest rates to customers is referred to as the cost channel of monetary policy. See for instance Barth III, M. J., & Ramey, V. A. (2001). "The Cost Channel of Monetary Transmission." In Bernanke, B. S. & Rogoff, K. (Eds.), NBER Macroeconomics Annual 2001, Volume 16 (pp. 199-240). MIT Press; Dedola, L., & Lippi, F. (2005). "The Monetary Transmission Mechanism: Evidence from the Industries of Five OECD Countries." European Economic Review, 49(6), 1543-1569; or Ravenna, F., & Walsh, C. E. (2006). "Optimal Monetary Policy with the Cost Channel." Journal of Monetary Economics, 53(2), 199-216.

-

The degree to which firms can flexibly set prices depends on a host of factors including market structure, demand elasticity, macroeconomic conditions, and the regulatory environment.

-

The recent period of high inflation should be viewed within the context of pre-existing inflationary pressures, driven by significant supply-side shocks, an economy rebounding from the Covid-19 pandemic and labour shortages. Unlike past episodes, the most recent inflationary period saw firms transferring, to a certain degree, higher production costs to consumers. This was largely due to the substantial mismatch between demand and supply across various sectors following the pandemic reopening. Consequently, wage increases significantly impacted prices, while profits remained elevated.

-

See O. Arce and D. Sondermann, “Low for long? Reasons for the recent decline in productivity”, The ECB Blog, 6 May 2024.

Related topics

Disclaimer

Please note that related topic tags are currently available for selected content only.