What a hotter climate means for monetary policy (The price of inaction)

- THE ECB BLOG

The price of inaction: what a hotter climate means for monetary policy

18 December 2023

By Friderike Kuik, Wolfgang Modery, Christiane Nickel and Miles Parker

This is the sixth post in our series accompanying COP28.

The ECB’s primary mandate is to maintain price stability. So why do we talk about climate change? In this post on The ECB Blog, we show how a hotter climate affects prices and the economy and discuss how this impacts the task of central banks.

A hotter climate leads to more frequent and more devastating extreme climate events – at significant economic costs. Current global efforts to prevent climate change fall far short of what is necessary to prevent catastrophic consequences. This blog describes how a changing climate adversely affects the economy. As such, climate change could hinder central banks as they go about delivering on their primary mandate of price stability.

Hot summers mean higher food prices

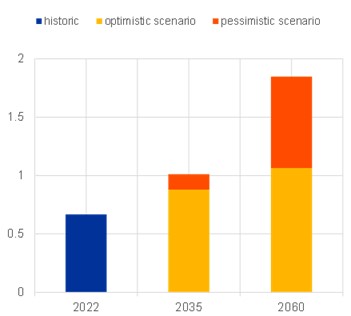

Hotter-than-usual summers can affect both inflation and inflation volatility, which are deeply relevant for price stability. Usually, there is a direct upward impact through higher food prices for several months. For example, ECB research estimates that the extreme summer heat in 2022 increased food inflation in Europe by around 0.7 percentage points (Figure 1, blue bar). Looking further ahead, this effect may be even more pronounced: we estimate that food inflation could rise by around 1.8 percentage points in an extreme summer in 2060’s climate, relative to a hypothetic scenario without any climate change. Services inflation can also be affected, presumably because higher food prices increase prices in restaurants and cafés, and because tourism-related services are more strongly affected by hotter temperatures.

Figure 1

Impact of heatwaves on food price inflation

Estimated impacts of summer heat on food price inflation

(percentage points)

Sources: Kotz et al. (2023). Notes: Estimated with a global panel regression approach, using monthly prices and high-resolution climate data. Cumulative deviation of food inflation from baseline after 12 months due to extreme June/July/August temperatures are shown. The chart is based on combining elasticities of a 1°C increase in temperatures with results from 21 global climate models. Projected temperatures of a 2022-like summer (i.e., in the upper tail of the temperature distribution) in future climates are retrieved from climate model results under an optimistic (“below 2C by 2100”, RCP2.6) and a pessimistic (“hot house world”, RCB8.5) emissions scenario. Impacts could be reduced through ambitious adaptation to warmer climates.

Continued climate change will likely dampen output

Climate change can also affect other key economic variables that matter for monetary policy and its transmission to the real economy and prices, such as potential output. While not directly measurable, potential output is important for understanding the degree of inflationary pressures. It represents the highest level of output the economy can sustain without generating inflation. Imagine potential output as the speed limit for the economy – once economic activity exceeds potential output, inflationary pressures rise and central banks have to start putting their foot on the brake.

There is evidence that climate change can reduce potential output growth. Here are a few examples of how continued climate change could weaken our economies:

- Floods and storms can destroy factories, machinery and infrastructure.

- Reduced snowfall will jeopardise the viability of ski fields in Europe, and many Mediterranean regions may become too hot for summer tourism. They are also threatened by rising sea levels.

- Agricultural yields will likely be depressed by higher average temperatures. While changing crops can help alleviate some of the effects, greater variability of temperatures and changing rainfall patterns are also likely to dampen agricultural output.

- People are getting less productive in the heat. We work most efficiently within a temperature range of around 19-22°C. Global warming means more days above critical thresholds, particularly in countries that are currently hotter on average. Indeed, the Cypriot Government issued a decree in summer 2023 limiting outdoor work on certain days in order to protect workers.

- Droughts affect more sectors than agriculture: the Rhine has become almost impassable for river freight on several occasions in recent years, with an impact on supply chains, and the Panama Canal faced similar restrictions in summer 2023.

The aggregate economic impact of these channels is uncertain, also in part because climate change adaptation – such as air conditioning, irrigation, and coastal defences – can alleviate the impacts. Insurance provides a further tool for adaptation, although there is already a substantial climate insurance protection gap in Europe.

While adapting economies to a hotter climate is necessary, it will also be costly. It diverts resources that would have otherwise gone into innovation, investment in productive activities or consumption. In addition, it will largely fall on local and national governments to pay for the adaptation to a hotter climate. They will have to shoulder much of the costs arising from uninsured natural disasters. We will thus likely see an increased strain on public finances, which could reduce the scope for stabilising fiscal policies and even impinge on fiscal soundness.

What this means for central banks

Continued global warming makes inflation more volatile because it affects inflation differently across various components, countries and seasons. For instance, while hotter summers increase inflation, an unusually warm winter can result in lower inflation as there is lower demand for heating. Such volatility poses a challenge for central banks since it may make it difficult to separate temporary from more permanent shocks. This makes it even harder to forecast inflation accurately. Moreover, the uneven impact of climate change on countries makes it more challenging to conduct monetary policy in the euro area, since it may increase inflation differentials between Member States.

In a low potential output growth scenario, opportunities for future profit are rarer, and businesses will no longer be prepared to borrow at as high interest rates for investment. Banks could consequently lower their interest rates for borrowers and savers. This would reduce the policy space available to central banks to stimulate the economy during downturns. In such a world, monetary policy makers might have to turn more frequently to negative interest rates.

Climate change can also cause losses in the financial system. Banks in particular play a crucial role in transmitting changes in monetary policy to households and businesses. The ECB’s first economy-wide climate stress test found a substantial increase in the probability of default of loans made by euro-area banks in a “hot house world” scenario. Such losses would likely impair credit provision of commercial banks. This can harm the effectiveness of monetary policy.

The longer we delay the transition of our economies, the greater the damage will be. In turn, procrastination will complicate the ECB’s task of delivering price stability.

The views expressed in each article are those of the authors and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Related topics

Poslední zprávy z rubriky Makroekonomika:

Přečtěte si také:

Příbuzné stránky

- Green Climate World - aktuální a historické ceny kryptoměny Green Climate World, graf vývoje ceny kryptoměny Green Climate World - 2 dny - měna USD

- Green Climate World - aktuální a historické ceny kryptoměny Green Climate World, graf vývoje ceny kryptoměny Green Climate World - 3 roky - měna USD

- KTERÁ MĚNA VYHRAJE SOUTĚŽ POPULARITY ANEB „What is hot and what is not?“

- Která měna vyhraje soutěž aneb „What is hot and what is not?“

- Defi For You - aktuální a historické ceny kryptoměny Defi For You, graf vývoje ceny kryptoměny Defi For You - 3 roky - měna USD

- Defi For You - aktuální a historické ceny kryptoměny Defi For You, graf vývoje ceny kryptoměny Defi For You - 1 den - měna USD

- Defi For You - aktuální a historické ceny kryptoměny Defi For You, graf vývoje ceny kryptoměny Defi For You - 2 roky - měna USD

- Defi For You - aktuální a historické ceny kryptoměny Defi For You, graf vývoje ceny kryptoměny Defi For You - 3 měsíce - měna USD

- Defi For You - aktuální a historické ceny kryptoměny Defi For You, graf vývoje ceny kryptoměny Defi For You - 1 rok - měna USD

- Defi For You - aktuální a historické ceny kryptoměny Defi For You, graf vývoje ceny kryptoměny Defi For You - 5 dnů - měna USD

- Defi For You - aktuální a historické ceny kryptoměny Defi For You, graf vývoje ceny kryptoměny Defi For You - 2 dny - měna CZK

- Defi For You - aktuální a historické ceny kryptoměny Defi For You, graf vývoje ceny kryptoměny Defi For You - 2 dny - měna USD

Prezentace

14.11.2024 Dosáhne Bitcoin 100 000 USD do konce roku?

13.11.2024 Jaké je hlavní využití ekonomického kalendáře?

Okénko investora

Radoslav Jusko, Ronda Invest

Petr Lajsek, Purple Trading

Jakub Petruška, Zlaťáky.cz

S návratem Donalda Trumpa zlato prudce klesá. Trhy zachvátila pozitivní nálada

Miroslav Novák, AKCENTA

Olívia Lacenová, Wonderinterest Trading Ltd.

Starbucks v červených číslech: Přinese vize nového generálního ředitele oživení?

Mgr. Timur Barotov, BHS

Jiří Cimpel, Cimpel & Partneři

Portfolio 60/40: Nadčasová strategie pro dlouhodobé investory

Ali Daylami, BITmarkets

Trump vs. Harris: komu majitelé kryptoměn coby voliči dají radši hlas?